Contact Us : 800.874.5346 International: +1 352.375.0772

The process to become a CPA as an international candidate is the same as for a domestic candidate.

You will need to:

NOTE: The application from the state board of accountancy will explain the steps you will need to complete for each particular jurisdiction.

Choosing which U.S. jurisdiction to apply to for the CPA certification can be confusing, and international CPA candidates have a few additional concerns. Most importantly, you will need to apply through a jurisdiction in the United States.

The normal considerations for selecting a U.S. jurisdiction apply to many international candidates, such as where you plan to practice, how you apply, registration and application fees, etc. For more information on the general considerations for selecting a U.S. jurisdiction, visit our resource on choosing a state board! To read about international-specific concerns, continue on this page.

Because each U.S. jurisdiction sets their rules for the CPA license, you will need to research each state’s requirements before you apply.

Gleim has developed a state board requirement resource that includes the most important categories for all 55 U.S. jurisdictions. This resource is completely free and a great way to narrow your search before you invest too much money or time.

We provide links to the state boards on our state requirement page so you can find more information!

Most of the information CPA candidates need can be found online. NASBA provides some information on all of the U.S. jurisdictions, and many state boards also maintain their own websites that provide additional information.

In addition, the state boards usually have contact information that is publicly available. Contacting a state board directly is the best way to ensure the information is correct. However, because there are 55 U.S. jurisdictions, it is a good idea to narrow down your search prior to contacting state boards.

NASBA International Evaluation Services (NIES) Opens in new window is a great tool for narrowing your search to a small pool of jurisdictions that most closely meet your education and documentation requirements.

NIES allows candidates to apply for an education evaluation with an undecided jurisdiction for US $350. NIES will suggest up to three jurisdictions based on your education and the state’s residency and Social Security number requirements.

If you do not fit the education requirements for any jurisdictions, NIES will still list up to three jurisdictions and note any requirements you do not currently meet.

NASBA’s ALL Opens in new window is another great tool for researching different U.S. jurisdictions. This paid service has two packages for CPA candidates:

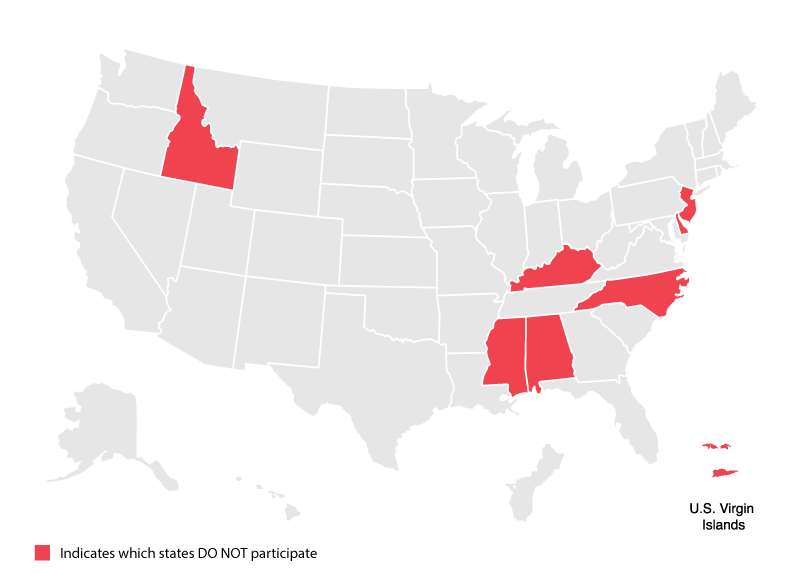

Not all U.S. jurisdictions participate in the international administration of the exam. You can still apply to these jurisdictions, but you will need to travel to the United States to sit for the exam.

All state boards have their own requirements that must be fulfilled before you are able to sit for the CPA Exam. Chief among those is an evaluation of your education transcripts. You may also be required to have your experience verified and provide other verification of the requirements.

The following jurisdictions DO NOT currently participate in international administration of the exam:

Once you have selected a U.S. jurisdiction, applying to the board of accountancy is very straightforward.

Most state boards have an application that can be requested from their website or by mail.

For detailed information on how to apply to a board of accountancy and the CPA Exam, visit our guide on applying for the CPA Exam.

As an international candidate, you will go through the same process as a domestic candidate when it comes to scheduling the CPA Exam.

For general scheduling considerations, visit our guide to scheduling the CPA Exam.

The international CPA Exam is no different from any other version of the CPA Exam. International candidates will have the same types of questions and will be graded the same way as all other examination candidates.

In order to take the CPA Exam in an international location, you will need to sign the International Consent Agreement Opens in new window. It requires you to obtain a license from a state board of accountancy within three years of passing all four parts or your exam scores can be automatically withdrawn, with all rights and privileges to them terminated.

Once you have passed the CPA Exam, met all education requirements, and completed the work experience requirement, you will be able to apply for the CPA license. This process is no different for international candidates and is conducted directly through your jurisdiction’s board of accountancy.

If you are an accounting professional and a member of certain non-U.S. professional associations, you can increase your credentials by passing the IQEX Opens in new window.

NOTE: Mississippi, Georgia, and Puerto Rico do not accept IQEX. North Carolina accepts only Canada CPAC. All other states accept IQEX.

The IQEX gives international accountants the opportunity to get the CPA certification through their membership with specific non-U.S. professional associations that have entered into agreements with the NASBA/AICPA International Qualifications Appraisal Board (IQAB). To read more about these agreements check out the NASBA webpage Opens in new window.

Eight organizations maintain these agreements with the United States:

If you are a member of one of these associations, you may be able to take the IQEX.

Each association has specific qualifications that candidates must meet in order to take the IQEX, so be sure to review these requirements before you start the application process.

If you are eligible to take the IQEX exam, you will apply through NASBA Opens in new window.

To apply to take the IQEX, you will need to submit a Letter of Good Standing from your professional institution. NASBA will not release your Notice to Schedule (NTS) until after they have received your letter.

NOTE: Your NTS is the document you will use when scheduling your exam. You will not be able to schedule the exam unless you have a valid NTS.

NASBA estimates the process should be complete within 5 business days. After your application has been processed and you have paid all of your fees, NASBA will release your NTS. You will receive a confirmation email, at which point you must create a NASBA Candidate account to access your NTS. You can also reprint it from NASBA’s website.

When you get your NTS, check that the information on your NTS and your identification documents match. If they do not exactly match, contact NASBA immediately. Your NTS is only valid for six months.

If your NTS expires, you will not be able to take the exam, extend the time period, or receive any refunds for fees you may have paid. You should make an exam appointment with Prometric, the testing center for the IQEX, as soon as you acquire your NTS.

The IQEX exam uses the same content and format as the CPA Exam’s Regulation section. It is a computer-based test that lasts for four hours and has five sections:

You can take the IQEX throughout the year for states and locations supporting continuous testing. Otherwise, the IQEX exam is offered during four testing windows each year. The testing periods are:

The IQEX exam covers topics such as Ethics, Professional, and Legal Responsibilities; Business Law; and Federal Tax Process, Procedures, Accounting, and Planning.

For more information on the format and content of the IQEX, visit our CPA Regulation resource page.

To prepare for the IQEX, you can use the Gleim CPA Review course for Regulation.

To learn more about the eligibility requirements of the International Qualification Examination and applying through NASBA, visit NASBA’s IQEX page Opens in new window, and to schedule your exam appointment, visit Prometric.com Opens in new window.