Contact Us : 800.874.5346 International: +1 352.375.0772

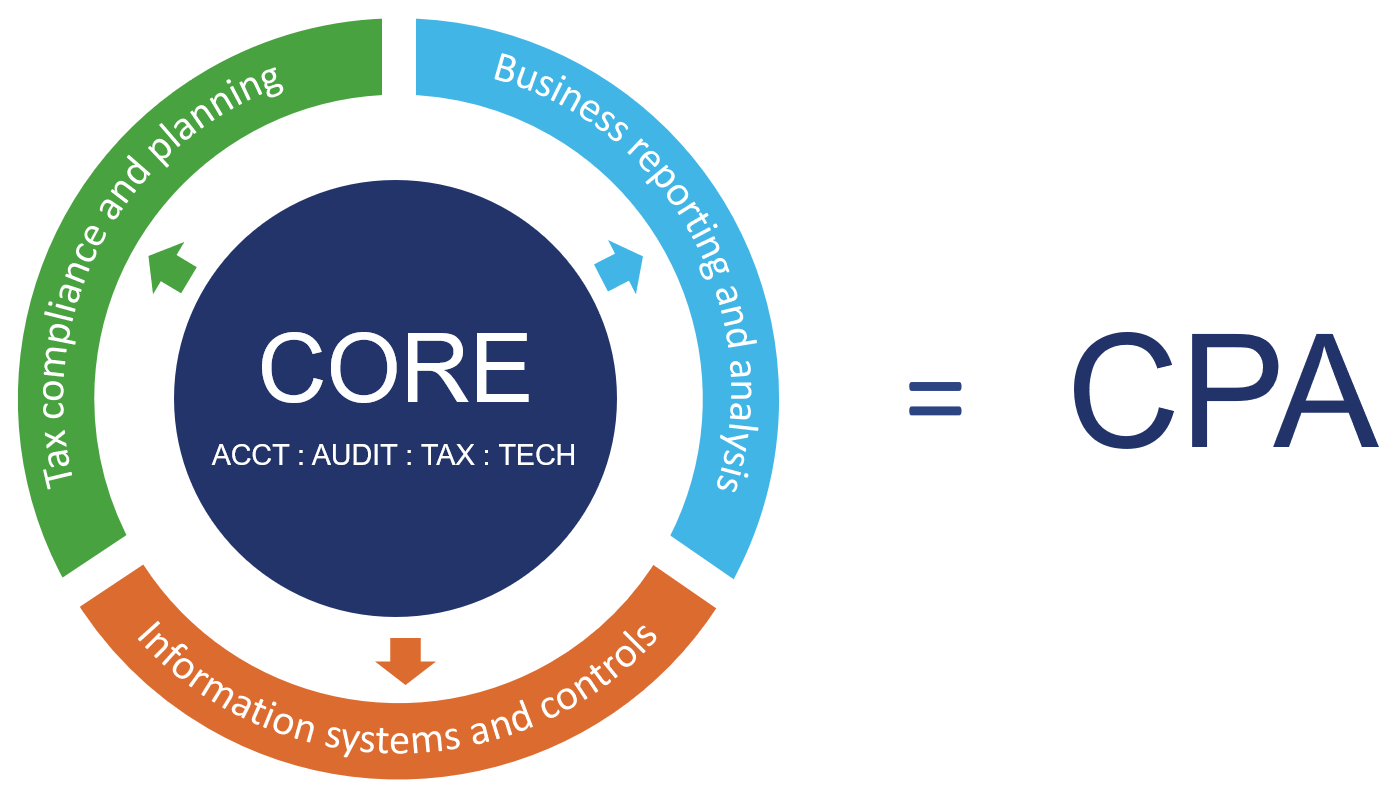

Below, each discipline is broken down into specializations within the accounting field. Explore each discipline and identify the one that interests you the most and that you could envision yourself working in.

| Exam Structure | Score Weighting | Skill Levels Assessed | ||||||

|---|---|---|---|---|---|---|---|---|

| Discipline Section |

Allotted Time |

MCQs | TBSs | MCQs | TBSs | Remembering & Understanding |

Application | Analysis |

| BAR | 4 hours | 50 | 7 | 50% | 50% | 10-20% | 45-55% | 30-40% |

| ISC | 4 hours | 82 | 6 | 60% | 40% | 55-65% | 20-30% | 10-20% |

| TCP | 4 hours | 68 | 7 | 50% | 50% | 5-15% | 55-65% | 25-35% |