Contact Us : 800.874.5346 International: +1 352.375.0772

Everything you need to know about the changes coming to the CPA Exam, consolidated and analyzed in one easy-to-reach place.

Starting in 2025 the Core sections of the CPA Exam will return to continuous testing.

Receive scores promptly

Continuous testing allows CPA candidates to get their scores after 1-2 weeks after sitting for a Core part of the CPA exam, as opposed to prior years where you would had to wait a month or longer to receive your score.

Increased testing windows

Continuous testing allows a candidate to have complete freedom over when they want to sit for their CPA Core part, whereas before there were dates where the CPA exam was not offered at all.

Ability to retake an exam in a shorter window

Waiting over a month to receive your score, discovering you failed, and then having to take a part of the CPA exam again is never a good feeling. Continuous testing allows you to quickly take the exam again while it is still fresh in your mind in two weeks, as opposed to waiting one to two months.

Take a look at our table here to see the Core score release dates for 2025.

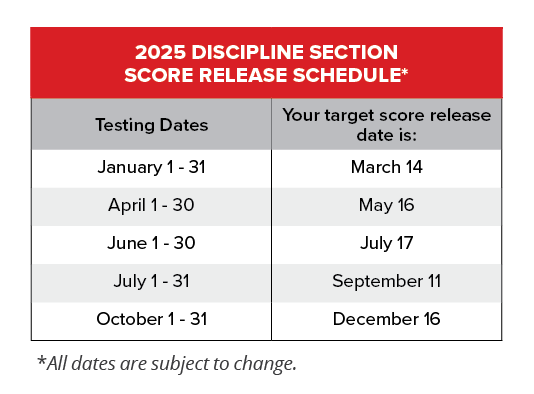

Discipline sections are similar to last year and will be administered the first month of each quarter, with it’s score release date being a month or two later. Here are the 2025 Discipline Score Release Dates:

Credit for passed CPA Exam sections will now remain valid for at least 30 months in most states, up from 18 months in past years.

NASBA recommended this change to ensure candidates can comfortably test for the CPA Exam without losing credit to life getting in the way.

Check with your state accounting board to see exactly how many months you have.

How many months do I have if I recently passed a CPA Exam section?

If your state has ratified NASBA’s rule change and you have exam credits that were valid on December 31, 2023, their validity has been extended to June 30, 2025.

The CPA Exam changes regularly. Gleim CPA Review takes new pronouncements, law changes, and the AICPA Blueprints into account when developing our materials, so there is nothing for you to worry about. In other words, you don’t need to stress about learning each of the Blueprint changes because Gleim updates your CPA review materials based on all of these changes.

But if you want to keep up with the landscape of CPA Exam changes, read on!

The CPA Exam changes taking place in 2024 are probably some of the most significant changes to take place since the CPA Exam went computerized in 2004. Since January 1, 2024, the CPA Exam tests the new blueprints that were released by the AICPA in January 2023. To read the full blueprints, visit the AICPA’s site.

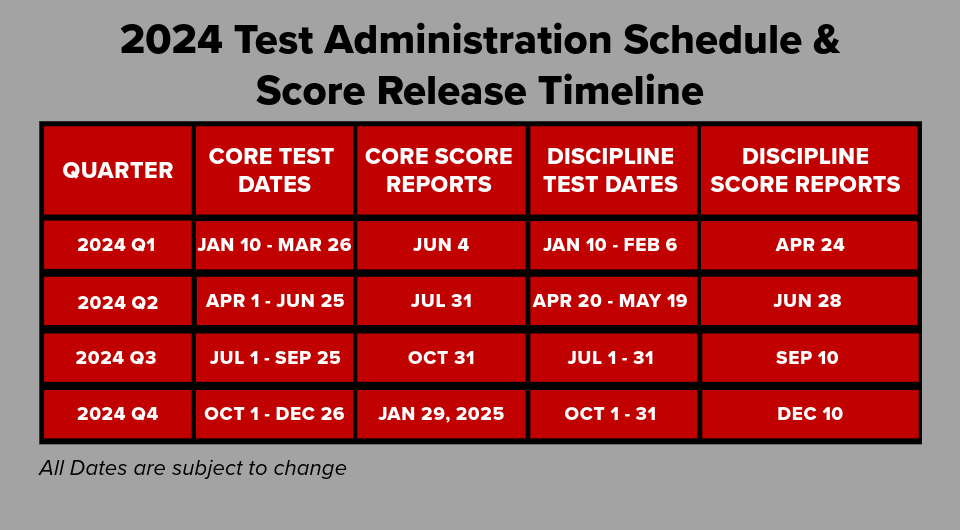

In addition to brand new content being tested on the CPA Exam in 2024 and new exam sections; there will be new testing dates and delayed score releases. Below is a chart of the revised testing dates and score release dates for 2024. With this, continuous testing is longer longer offered for the CPA exam.

The AICPA regularly revises sections, adds new topics, and removes outdated topics to make sure it reflects the latest professional standards and regulations of the following governing bodies:

Taking advantage of new technologies and improving the testing experience sometimes changes the interface or other administration elements of the CPA Exam.

Many of the changes are minor changes that improve how information is presented or clarify topics and testing material.

The CPA Exam Blueprints are a breakdown of the knowledge and skills the AICPA has deemed necessary for Certified Public Accountants. The AICPA uses these Blueprints when creating the CPA Exam and releases them as study guides for CPA candidates.

The AICPA usually releases CPA Exam Blueprints once or twice a year, and the changes do not go into effect immediately.

Within the Blueprints you will find

The most important thing to remember is that the Blueprints are not an exam rubric. They present sample tasks, but they are not limited to only testing the content areas with those tasks. Equally important: Not every topic on the Blueprint will be tested on every CPA Exam.

The CPA Exam changes every year, sometimes more than once. It can be hard to determine which changes are important, so let us do the work for you! Our free CPA Exam Guide includes everything you need to know about the CPA Exam. Studying with Gleim CPA Review means you never need to worry about CPA Exam changes—we always have you covered.