Contact Us : 800.874.5346 International: +1 352.375.0772

The Regulation (REG) CPA Exam section primarily covers three topics: business law, ethics, and federal taxation. The topic that receives the most attention is federal taxation in its various forms, which makes up over half of the exam!

The AICPA wants to know you can perform tax preparation and other services commonly required of CPAs. So to pass the REG CPA Exam, you’ll need to become familiar with tax law—but you’ll need to do more than memorize. Plan on reviewing material and then spending time working through questions and simulations that let you apply the rules you’ve learned.

The rest of this guide will equip you with what you need to know to prepare for the REG section of the CPA Exam. If you’re already studying, check out some of our free webinars and videos or make use of our free REG questions. You’ll also find here some study tips specifically for REG.

Contents

All about the Regulation (REG) CPA Exam Section

Why does the AICPA include pre-test questions on the REG exam?

• What is a CPA passing score?

• Can I receive partial credit on Task-Based Simulations (TBSs)?

• When are new pronouncements testable?

• When are new REG law topics testable?

REG CPA Exam time management

How do I prepare for REG?

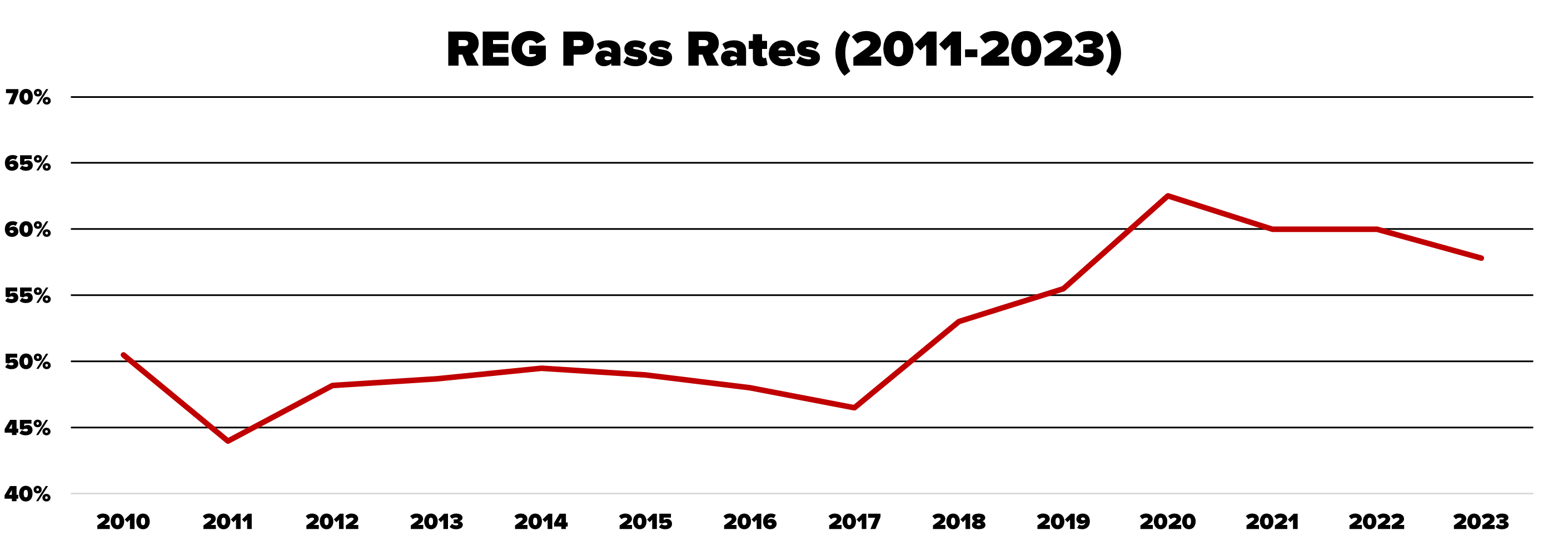

• What is the best way to study for the CPA REG Exam section?

For the past four years, REG has had the second highest CPA Exam pass rate. The cumulative REG pass rate has risen steadily recently, where it peaked at 62%. In 2021, REG’s pass rate decreased slightly to 60%. From 2012 through 2017, it stayed consistently around 50%, sharing the second and third positions with AUD. FAR had the lowest pass rate in 2021 at 45%. The exact pass rates shift a bit from year to year, but the CPA Exam sections’ relative difficulty has followed that dynamic for the past several years.

Take a more detailed look at CPA Exam pass rates, including seasonal trends.

Since 2011, the lowest pass rate REG has reported in one year has been 44%, and the highest has been 62%. That 62% pass rate is from 2020, and we’re seeing strong performances into 2022.

For more on how the CPA Exam has evolved and what’s new this year, visit our CPA Exam Changes page.

The REG CPA Exam section consists of five testlets: two testlets of multiple-choice questions (MCQs) and three testlets of task-based simulations (TBSs). The MCQ portion of REG accounts for 50% of your CPA Exam score, and the TBS portion accounts for the other 50%.

REG Format Breakdown

Testlet 1 36 MCQs

Testlet 2 36 MCQs

Total MCQs: 72 | Scoring: 50%

Testlet 3 2 TBSs

Testlet 4 3 TBSs

Testlet 5 3 TBSs

Total TBSs: 8 | Scoring: 50%

Testing Time 4 hours + 15 min break

Most REG testlets include operational and pre-test questions. Operational questions count toward your total exam score, and pre-test questions do not. That said, you can’t tell which questions are which so don’t waste any valuable testing time trying to decide whether you can afford to skip a question!

REG Question Categories | |||

Question Type | Operational | Pretest | Total |

MCQs | 64 | 12 | 76 |

| TBSs | 7 | 1 | 8 |

The AICPA looks to continuously evolve and improve the CPA Exam. Pre-test questions are potential future exam questions the AICPA is trying out by inserting them among real exam questions on REG and other CPA Exam sections. This lets it study how suitable the questions will be for future use.

The AICPA already knows what topics the operational questions test and how difficult they are, so it can analyze candidate performance on pre-test questions with the operational questions serving as a sort of control. While no one likes to be a guinea pig for experiments—especially on an exam this difficult—keep in mind that your score on these questions will not count.

The pre-test questions that meet the AICPA’s standards are included as operational questions on later iterations of the exam. This pre-test period is also used to assign a difficulty level to questions for grading purposes, and questions continue to undergo statistical analysis based on the live exam.

THE GLEIM SOLUTION

Pre-test questions may be perceived to be more difficult than operational questions, but because you can’t tell which are which, it’s best to answer all questions as best you can. If it helps, whenever you encounter a really difficult question and aren’t sure of your answer, just tell yourself it’s probably a pre-test question and keep moving!

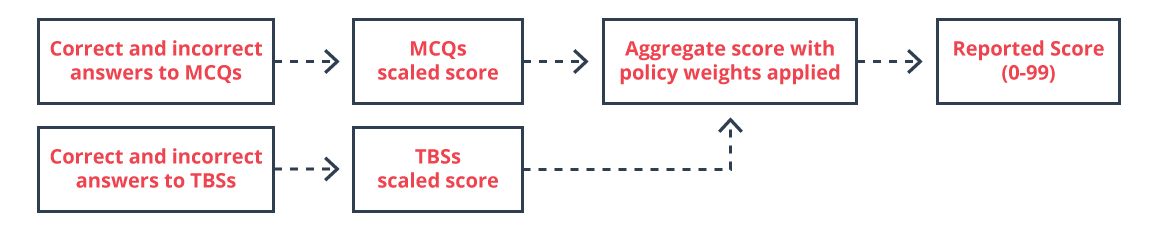

Computers grade all CPA MCQ and TBS testlets. Your final score is scaled according to the difficulty of the MCQs you answered correctly, your credit on the TBSs, and the weights assigned to the different types of testlets. (See more on how the CPA Exam is scored.)

The passing score for all CPA Exam sections is 75 points or higher.

This does not necessarily mean you need to answer 75% of questions correctly.

Difficult questions are worth more points, so a strong performance on the first MCQ testlet can give you an opportunity to earn even more points in the second MCQ testlet. Difficult questions are also more time-consuming, so you’ll need to practice a time-management strategy to optimize your score.

The CPA Exam is not curved. The purpose of the CPA Exam is to ensure that anyone who passes it can perform the duties of a CPA and will represent the profession well.

This grading process is fair because it ensures candidates who pass meet the minimum criteria established by the AICPA. Multi-stage testing aims to match question difficulty to proficiency level, so it takes fewer questions to accurately estimate candidate proficiency.

Yes, you can receive partial credit on TBSs! Never leave any part of a question blank on REG (or other sections for that matter), and always double-check to make sure you’ve answered all parts of a question. No two TBSs are the same. They can have wildly different formatting and require you to input your answer in different ways, so stay sharp.

For more information on how your REG section will be scored, please check out our guide to CPA Exam pass rates and scoring. You can also see the AICPA’s FAQs or contact one of our Personal Counselors. We’re always here to help!

Passing REG requires a strong understanding of ethics, business law, and federal taxation. The content is sourced from many different acts, regulations, etc., including:

The AICPA publishes CPA Exam BlueprintsOpens in new window that specify exactly what a CPA needs to know for REG, all the way down to specific tasks. The subject matter is divided into six content areas.

| REG CPA Exam Content For a breakdown on the exam contents, click the links below. |

|

|---|---|

| Content | Percentage |

| 10-20% | |

| 15-25% | |

| 5-15% | |

| 22-32% | |

| 23-33% | |

It’s good to look over the higher-level concepts to get a broad idea of what you should be taking away from your studies, but the Blueprints aren’t really useful for candidates who want to make a study plan. The Blueprints are incredibly detailed, and if you were to go through them on your own, you’d likely spend just as much time figuring out what to study and how much time to devote to each topic as you would actually preparing for the exam.

Our recommendation is to let a CPA Exam review course provider do the bulk of the work for you. Gleim has a team of experts that digs into each Blueprint update, taking the guesswork out of studying.

Tax laws are frequently amended, so the AICPA has specific guidelines for updating the relevant REG questions. Per the AICPA, changes in the Internal Revenue Code, and federal taxation regulations are eligible to be tested in the calendar quarter beginning six months after the change’s effective date or enactment date, whichever is later.

Changes in federal laws outside the area of federal taxation are eligible to be tested in the calendar quarter beginning six months after their effective date.

Changes in uniform acts are eligible to be tested in the calendar quarter beginning one year after their adoption by a simple majority of the jurisdictions.

For all other subjects covered by the CPA Exam, changes are eligible to be tested in the later of (1) the first calendar quarter beginning after the earliest mandatory effective date or (2) six months after the issuance date.

Once a new pronouncement is testable, questions testing the old pronouncement will be removed.

THE GLEIM SOLUTION

In our experience, the AICPA does not appear to hold hard and fast to these rules.

For example, you may see tax forms from prior years on your REG task-based simulations (TBSs), but don’t be distracted by dates. Simply complete the form to the best of your ability and follow all instructions in the question. If the exam provides an out-of-date tax rate, use that rate to answer the question.

Gleim Review Courses are automatically updated to reflect the latest material that could appear on the CPA Exam.

The REG section of the CPA Exam isn’t easy (none are). One factor contributing to CPA Exam difficulty is the fact that the exam assesses candidates at four different levels of skill. The pass rate for REG typically hovers around 50%. However, in 2021 the average jumped up to nearly 60%. Even so, it’s important to make sure you have a firm grasp of the subject matter.

Each skill level builds on the preceding one. The REG CPA Exam takes a balanced approach to testing at every skill level (except for Evaluation, which is only tested in AUD).

Analysis is one of the more difficult skill levels on the CPA Exam, but it is not hard to master when you review with a thorough CPA review course featuring the best test bank on the market. Gleim CPA Review covers the exam content better than any other course, and our high-quality practice simulations will help you achieve the analysis level of skill quickly and effectively.

If you have tax experience, REG may be the section you should take first. A good deal of REG content will be familiar to candidates who have had internships or worked in a public tax practice. If this describes you, or if you’re planning to begin work at a tax firm in the near future, consider scheduling this section early to build confidence. The knowledge you gain will be a great asset to you in your professional career.

For candidates without much tax experience, REG can be fairly tricky because there is a lot of material you must memorize before you can begin to apply it at a high level. FAR and AUD CPA Exam section content overlaps somewhat, so it’s usually best to schedule those sections close to one another. If you are not comfortable taking REG first, consider scheduling it last.

As you plan when to take the different sections, we recommend starting with the one you’re most familiar with to help position you for an early win. This can give you confidence and let you get comfortable with the CPA Exam.

The total testing time for REG is four hours, the same as the other CPA Exam sections. The five testlets of the REG CPA Exam section are independent. There are no time limits on the individual testlets, so it is up to you to manage your time appropriately so that you can complete all five testlets before the exam ends.

Based on the total time of the exam and the amount of time needed to complete each testlet, you should plan to spend:

MCQs

1.25 minutes each

TBSs

18 minutes each

REG Time Allocation by Testlet | |||

Teslet | Format | Question Count | Time (in minutes) |

| 1 | MCQ | 38 | 47 |

| 2 | MCQ | 38 | 47 |

| 3 | TBS | 2 | 36 |

| 15-minute break (does not count toward total exam time) | |||

| 4 | TBS | 3 | 54 |

| 5 | TBS | 3 | 54 |

| Extra Time | 2 | ||

| Total | 76 MCQs / 8 TBSs | 240 | |

As you can see from the small amount of extra time left over, this schedule is very tight. That’s because REG has more MCQs than any other exam section. Straying from this schedule greatly reduces your chances of passing. Do whatever you can to keep to a strict time management system. This includes making educated guesses when necessary and not stressing about difficult questions (remember, they might be pre-test questions!).

It will take a lot of practice to get to a place where you can answer questions this quickly. But as you learn the material and complete more sample questions, you’ll build mastery of the topics and get faster.

Use any extra time you have available. Those four hours are yours! Don’t risk leaving any points on the table.

To pass REG, you’re going to have to learn the ins and outs of federal taxation. This can be difficult content to work through. But as long as you have the right CPA Exam review provider to help you study thoroughly and at a manageable pace, you will be able to pass.

THE GLEIM SOLUTION

The Gleim Premium CPA Review course can help you pass REG on your first attempt. Our course covers the exam content better than any other and always contains the most up-to-date information. Our SmartAdapt™ technology works like a private tutor to help shore up any weak areas and make the most of your study time. The course also builds in review questions for maximum retention, which is really important when you’re dealing with tax law.

The REG practice questions you’ll see in the Gleim CPA Review are just as challenging and realistic as those on the actual CPA Exam. By the time you complete our Final Review, you’ll be completely prepared and confident for exam day!

We’ve compiled some of our top tips for the REG CPA Exam section.

1. Study early; study often.

Your exam score on REG will reflect the amount of time you put in, so put in as much time as you can and make the most of it. The most successful candidates know the huge effect stress and fatigue can have on their performance, so they set up a study calendar that accounts for their lifestyle and sleeping habits. An interactive study planner like Gleim’s lets you set a realistic schedule for your study sessions. Our study planner also tracks your performance, even making it possible for our Personal Counselors to support you right where you are in your studies.

2. Become familiar with federal taxation, especially income, gift, and estate taxation.

More than 70% of the REG exam focuses on federal taxation. If you’ve had coursework focused on taxation or worked in a public tax practice, you have an advantage. If you haven’t, don’t worry. Gleim CPA Review has the tools you need to master REG tax topics.

3. Practice applying concepts.

Rote memorization comes in handy on REG, but now more than ever the AICPA is testing candidates at a higher level. You’re expected to show you have the skills to provide tax preparation and advisory services. You’ll find what you need in the Gleim CPA Review, with a powerful bank of highly acclaimed practice questions built right into the course.

If you’re looking for a start-to-finish CPA Exam walk-through, download our free CPA Exam Guide for more information! This PDF contains our top tips for scheduling, studying, and sitting for the CPA Exam. You can bet we know a thing or two after helping candidates pass over a million CPA Exams in the last 40 years.

10-20% Ethics, Professional Responsibilities and Federal Tax Procedures

10-20% Ethics, Professional Responsibilities and Federal Tax Procedures

10-20% Business Law

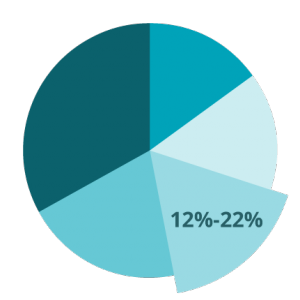

12-22% Federal Taxation of Property Transactions

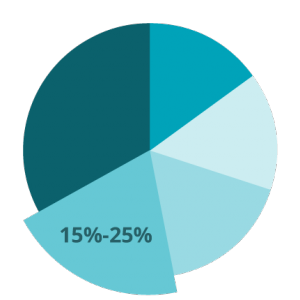

15-25% Federal Taxation of Individuals (including tax preparation and planning strategies)

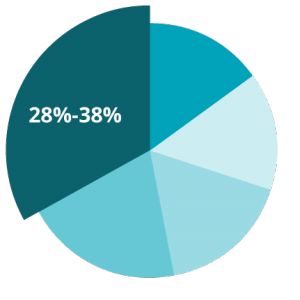

28-38% Federal Taxation of Entities (including tax preparation and planning strategies)