Contact Us : 800.874.5346 International: +1 352.375.0772

Like an architect drafts a skyscraper, the AICPA builds the CPA Exam using blueprints. The Blueprints are a series of accounting tasks, organized by topic, that a newly licensed CPA should know how to complete. The AICPA uses these tasks as a basis for all CPA Exam questions. In this article, we’ll help you become familiar with the Blueprints and understand what their role should be in your CPA Exam studies.

Most review providers examine the Blueprints ahead of time so their candidates don’t have to. That way, candidates have more time to study (and spend less time figuring out what to study). Using a comprehensive and adaptive review course ensures you get the most out of your study time.

The Blueprints, at their most granular level, consist of representative tasks, which the AICPA describes as “a brief explanation of what we’ll test you on with correlation to the skill that’s being tested.” The tasks are the action items of the Blueprints, and they are always introduced with a verb to highlight how they should be applied. For example:

In each section of the exam (AUD, BEC, FAR, and REG), representative tasks are organized into topics; topics are organized into content groups; and content groups are organized into content areas. Each exam section is made up of four or five content areas. These explain the hierarchy of topics on the exam and give context to the representative tasks.

While the Blueprints provide all of the concepts that make up the CPA Exam, they do not have any of the actual content needed to study. Each question the exam asks relates directly to something in the Blueprints; so, theoretically, if you can complete every representative task in the Blueprints, you can pass the CPA Exam. This makes the tasks extremely useful to CPA review providers in a number of ways.

It tells us

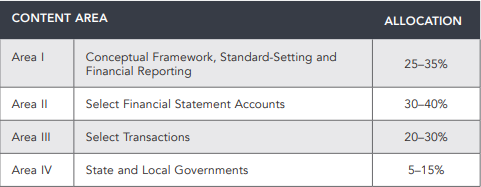

The Blueprints also reveal the percentage of content area covered on each exam section. For example, FAR is made up of these four content areas:

If you’re wondering whether you should spend more time studying State and Local Governments or Select Financial Statement Accounts, this content area allocation included in the Blueprints easily answers that.

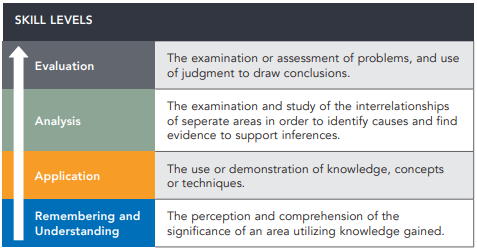

The skill portion of the Blueprints indicates what level of understanding each task requires. Representative tasks are assigned one of four skill levels:

Remembering and Understanding is the simplest skill level, and Evaluation is the most complex. According to the AICPA, Remembering and Understanding questions are almost always multiple-choice, Application questions could be either multiple-choice or simulations, and Analysis and Evaluation questions will almost always be Task-Based Simulations. The Evaluation skill level is only tested through AUD simulations. Written Communication questions (BEC only) and Research questions test at the Application skill level.

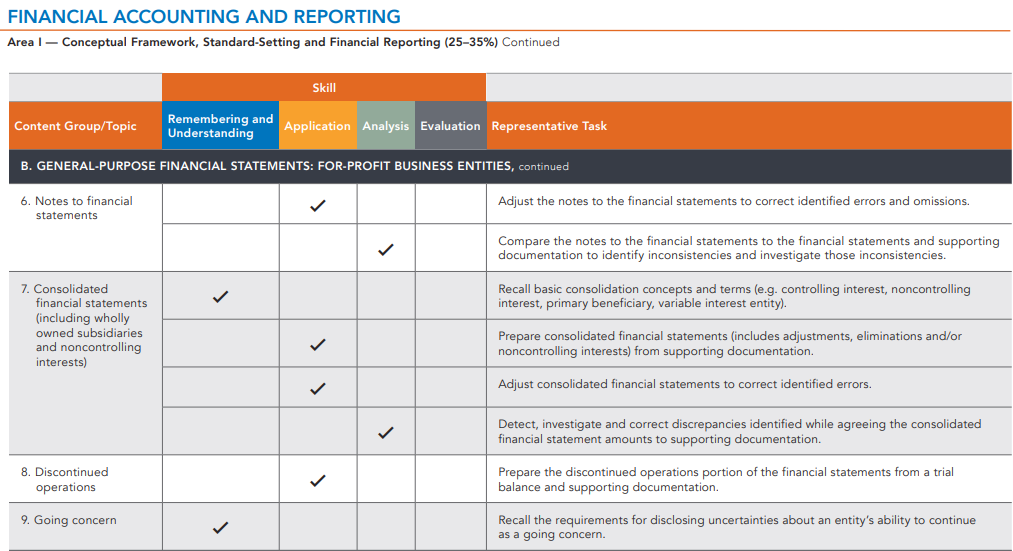

For example, look at topic 7 in the graphic:

DO: Use them as a high-level guide to the exam.

As previously stated , the Blueprints offer an overview of CPA Exam concepts, but they don’t dive into specific exam content. Still, they can be useful to you. According to the AICPA, reviewing the Blueprints can tell you what topics will be addressed on the exam and allow you to get a feel for the content. They also outline which content areas will have heavier coverage.

The AICPA strives for complete transparency regarding CPA Exam content. There should be no surprises come exam day. “[The CPA Exam Blueprints are] a public document,” said Joseph Maslott, Senior Manager at the AICPA. “[They represent] what’s on the exam, believe it or not, we’re not trying to trick or mislead you.”

DON’T: Replace your formal review provider with the Blueprints.

It is possible for you to use the Blueprints to make your own study plan. After all, they do outline everything you need to study. Who needs a review provider when you have all of the topics on the exam laid out for you?

Most candidates do. And even those who can figure out the Blueprints probably should still use a review provider.

It would be nearly impossible to pass the CPA Exam using only the Blueprints. You would spend an eternity reading and memorizing all the accounting rules and laws that inform the CPA Exam Blueprints. Most people would not be able to absorb it all in time to pass all four sections in the 18-month window.

Additionally, just memorizing the content doesn’t teach you how to think analytically about these topics. You can get to a Remembering and Understanding level, but only guidance from a review provider in the form of comprehensive outlines, challenging multiple-choice questions, and realistic task-based simulations can get you to the Evaluation level.

Learning to apply accounting principles and analyze problems is an essential part of studying for the CPA Exam, and studying without a review provider will not prepare you for that. For over 45 years, Gleim has built a business around teaching these topics in a way that prepares candidates to pass the exam with confidence. Our courses focus on understanding concepts and learning to apply them in a variety of situations. This way, you can answer all the CPA Exam questions without having to read every word of every accounting rule.

The Gleim CPA Review course incorporates the topics from the CPA Exam Blueprints into our comprehensive content to teach you exactly what you need to know to crush the CPA Exam. Our SmartAdaptTM technology determines your weak areas and adapts the review to create a study plan to fit your individual study needs. With Gleim, there is no guessing what’s on the exam. We use proven techniques to ensure you’ll pass the exam the first time. Check out our free CPA Exam guide and see how Gleim can help you become a CPA.