Contact Us : 800.874.5346 International: +1 352.375.0772

The American Institute of CPAs (AICPA) releases aggregate CPA Exam pass rates quarterly after each testing window. Gleim reports these pass rates here immediately—we know you’re excited to see how the entire cohort did!

The latest passing data also helps us understand how CPA Exam changes affect candidate performance, so we analyze and compare CPA Exam pass rates throughout the years. We highlight important patterns and examine how the AICPA calculates CPA Exam scores here, too.

CPA Exam candidates receive their scores individually during scheduled CPA Exam score releases.

2025 CPA Exam Pass Rates |

|||||

|---|---|---|---|---|---|

| Section | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Cumulative |

| AUD | 44.30% | – | – | – | 44.30% |

| FAR | 41.67% | – | – | – | 41.67% |

| REG | 62.03% | – | – | – | 62.03% |

| BAR | 37.64% | – | – | – | 37.64% |

| ISC | 61.23% | – | – | – | 61.23% |

| TCP | 74.94% | – | – | – | 74.94% |

Starting in 2025, the Core sections of the CPA Exam will return to continuous testing.

Easier to schedule

No more “testing windows.” You now have freedom to decide when you want to sit for a Core CPA Exam section. Other than the few blackout dates the AICPA uses to update the exam, you can schedule for whenever is convenient.

Faster score reporting

Continuous testing allows you to get your scores 1-2 weeks after you take a Core CPA Exam section, as opposed to prior years when scores releases were batched for each window. Candidates used to wait a month or longer to receive their scores.

Better for retakes

Now that candidates receive scores promptly, no one has to spend weeks studying for their next section only to find out they have to retake their last one. Continuous testing allows you to take the exam again in two weeks, while the content is still fresh in your mind.

Take a look at our table to see the Core score release dates for 2025.

Discipline sections are similar to last year and will be administered the first month of each quarter, with it’s score release date being a month or two later. Here are the 2025 Discipline Score Release Dates:

CPA Exam candidates receive their scores individually during scheduled CPA Exam score releases. The AICPA releases the aggregate score for each section quarterly–the Q1 2024 CPA Exam pass rates are below!

2024 CPA Exam Pass Rates |

|||||

|---|---|---|---|---|---|

| Section | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | Cumulative |

| AUD | 44.63% | 46.58% | 47.80% | 43.50% | 45.63% |

| FAR | 41.92% | 40.58% | 39.82% | 36.80% | 39.07% |

| REG | 63.42% | 63.45% | 62.97% | 60.40% | 62.56% |

| BAR | 42.94% | 40.26% | 40.11% | 33.70% | 39.25% |

| ISC | 50.93% | 57.93% | 61.88% | 56.40% | 56.79% |

| TCP | 82.36% | 75.67% | 72.91% | 72.20% | 75.79% |

TCP by far has the highest pass rate with a massive 82.36%. This might come as a surprise because it is a discipline section that has not been tested yet, but there are a few contributions to the TCP pass rates according to the AICPA:

Pass rates will change with candidates retesting, pass rates becoming public, candidate’s preference of which exam to sit for, etc., all of which is completely normal for the CPA exam pass rates.

The CPA Exam is difficult for a reason. The certification is sought after because it is meaningful. It signals to employers and peers a certain caliber of professionalism. If the CPA Exam was easier, the market would be saturated with CPAs, many of whom would not be able to contribute at the highest level. The CPA Exam pass rate is something the AICPA is continuously monitoring to make sure accountants who earn the CPA embody its standard.

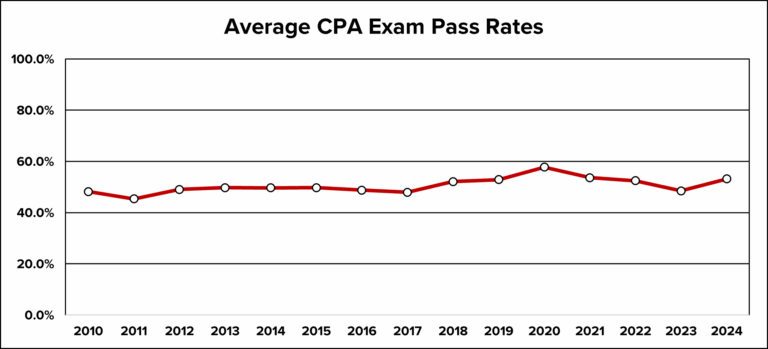

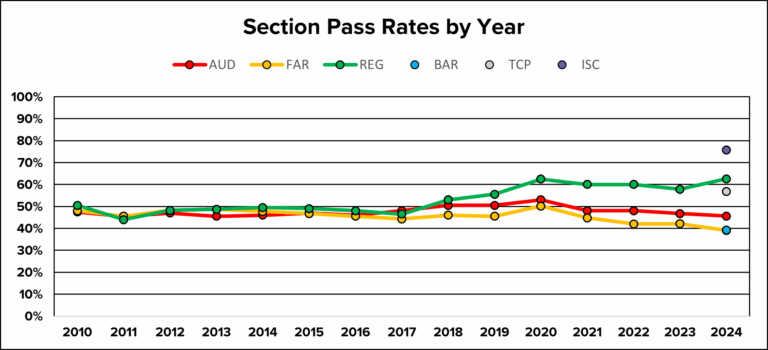

The AICPA has reported CPA Exam pass rates since 2006, and for 16 years, the cumulative average pass rate has improved and now fluctuates between 45% and 60%.

The cumulative average CPA Exam pass rate for 2023 dropped a little as a result of poor candidate performance on the BEC section in the last quarter of 2023. The average cumulative score for 2023 was near 2017 levels. 2023 represents the last year of the “old” exam. As candidates test in 2024, they continue to see a unique set of challenges as they test for each of their exams.

Pass rates for the 4 exam sections have been fairly consistent over recent years. 2023 provided some unique candidate behavior given the new exam launching in 2024 and many attempting the BEC exam before it went away. As a result, the 2023 pass rate data provides some shifts in the BEC pass rates.

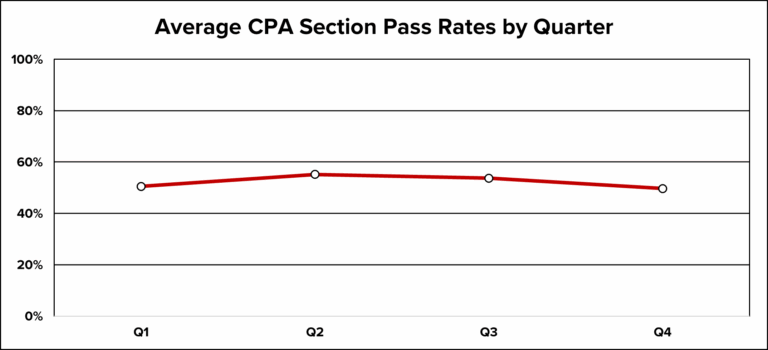

CPA Exam pass rates don’t just change from year to year, they also fluctuate a lot from quarter to quarter. We’ve studied CPA Exam pass rates closely for over 45 years.

Before 2020, when the CPA Exam still had testing windows, there was a trend of low pass rates in Q1 and Q4, with higher pass rates in Q2 and Q3. However, the exam itself is no more difficult or easier during these quarters. The pass rates are almost entirely affected by outside influences, such as holidays and school semesters.

Since Continuous Testing has been adapted, we expect to see similar trends due to these outside influences. However, since there are more opportunities to sit, we may also see the pass rates flatten a bit as CPA Exam candidates have their choice of exam date.

The best way to ensure you will pass your exams is to have a study plan that works for you. We have tips and strategies to help you create your perfect study plan.

There are a lot of factors that determine pass rates: how hard the exam is, how prepared candidates are, any changes the exam is undergoing, etc. Also note: recorded pass rates for the CPA Exam only go back to 2006. The first “CPA Exam” was delivered by the New York Board of Examiners in 1896, so we’re unfortunately missing a lot of data (not that it would be useful for today’s CPA candidates). Let’s look at what affects the modern CPA candidate.

Q1 (January-March) is the start of the busy season for tax accountants. People who work full-time probably find it hard to keep up with studying, so it falls by the wayside. Pair this with the fact that Q1 comes right after the holiday season, another time candidates probably find poorly suited for studying, and fewer people end up passing.

Q2 (April-June) is the first chance most college graduates have to take a CPA Exam section. They don’t have much time to study immediately after classes end, so most likely they have been studying while classes were in session. While they do pass at a high rate, they are not quite as prepared as they might have been in Q3.

Q3 (July-September) is a perfect time for college graduates to take a section of the CPA Exam. Students who graduate in May have all summer to study for the next section. There are very few holidays during that time, and many students probably want to finish so they don’t have to study during the holidays later in the year. This sets them up to do very well when they sit in Q3.

Q4 (October-December) pass rates could be low due to the holiday season, much like Q1. Recent graduates who began the testing process as a student are largely able to complete the testing process by the end of Q3, and so aren’t contributing to the average in Q4.

Accounting coursework overlaps with many CPA Exam topics, so current and recent students tend to perform well on the exam.

These explanations are all conjecture. Still, walking through this reasoning is important because there are critical factors for candidates to consider outside of the CPA Exam itself. While passing still depends largely on how well prepared you are, you should still be aware of the way your environment affects you and craft your study plan in a way that gives you every possible advantage. Are you someone who, no matter how hard you try, will never get work done over the holiday season? Consider that when scheduling your exam. Learn more in our guide to scheduling the CPA Exam.

We’ve already shown that the CPA Exam is difficult. But whatever the pass rates are, they don’t have to define your chances of success. The best thing you can do to ensure you pass on your first attempt is to have a solid CPA review provider by your side when you sit for the exam.

Each candidate who chooses to study with Gleim CPA Review has access to a team of Personal Counselors who can help you create a personalized study plan and will walk you through each step of the exam process. With SmartAdapt™ technology at your side, you’ll be on the path to success.

Passing the CPA Exam is one of the four requirements to become a CPA. It is designed to measure professional competence in auditing, business law, taxation, and accounting. The AICPA’s goal is for every candidate who passes the exam with the minimum passing score of 75 to reflect positively on the profession.

To that end, the exam also tests related business skills, the ability to conduct oneself skillfully and with good judgment, and understanding of professional responsibilities and ethics. Passing this exam confirms you have the competence to practice in a highly specialized field.

The AICPA contracts with third parties to produce multiple-choice questions (MCQs), and task-based simulations (TBSs). Exam questions are created and vetted by experts in the fields of accounting, psychometrics, and test development.

Through the development process, these experts ensure that testlets and exam versions will be graded and scored equitably on a comparative basis. The AICPA is ultimately responsible for the creation and maintenance of the CPA Exam.

The CPA Exam is administered at Prometric test centers in partnership with the National Association of State Boards of Accountancy (NASBA). After you apply to your state board of accountancy, you will schedule and sit for your exam with Prometric.

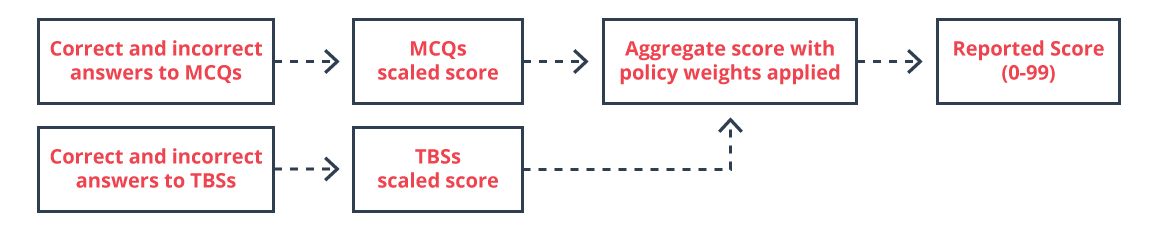

The CPA Exam is scored in a largely automated process. MCQs, and TBSs, are all graded electronically.

The minimum CPA Exam passing score is 75 points, but that doesn’t necessarily mean you need to answer 75% of questions correctly in order to pass.

The CPA Exam is what is known as a criterion-referenced test, which means every candidate’s performance is measured against established standards to determine whether the candidate has demonstrated the level of knowledge and skill represented by the CPA passing score.

The CPA Exam is not curved in the traditional sense. Every candidate is held to the same standard. The AICPA uses Item Response Theory (IRT) to figure out the relative value of MCQs and TBSs. It rates questions according to three statistics:

Using the collected data, the AICPA is able to extrapolate scores from different exam forms that accurately represent candidates’ knowledge and skill levels. These scores are comparable because, to put it simply, difficult questions are worth more points and easier questions are worth fewer. It is entirely possible for two candidates to answer the same number of questions correctly and have slightly different scores.

The scores from each testlet are then multiplied by the policy weights:

Finally, the aggregate score is mapped to the 0 to 99 scale used for score reporting.

The AICPA Board of Examiners sets the CPA passing score by considering historical trends, changes in content, input from the academic community and profession, and other sources. The score is set such that a candidate who passes with the lowest possible score will reflect positively upon the professional community. Anyone who scores a 75 or higher is capable of performing the duties of a newly minted CPA.

The AICPA regularly sets four CPA Exam score release dates per window. For the most part, you can expect your score a few weeks to a month after you sit for the exam.

When your CPA Exam score release date arrives, there are two ways to get your score:

The AICPA does not release sub-scores by content area, but it does report “weaker,” “comparable,” and “stronger” performances. Exercise caution when interpreting your content area performance, because these sub-scores are calculated using a relatively small number of questions.

For example, in REG, 10-20% of your exam will be on “Ethics, Professional Responsibilities and Federal Tax Procedures.” If your exam only contains 10% of questions on that topic, that’s about 8 multiple-choice questions and maybe a TBS. It’s useful to know how you did, but we don’t advise drawing conclusions about your mastery of the topic based on such a small sample size.

If you fail a CPA Exam section, don’t panic. We have steps to get you back on track on our blog.

If you decide to retake any section of the exam, we recommend you go through all of the material again at least once. A lot of time can pass between attempts, and it is best to keep the material fresh in your mind.

Read more about how to improve your CPA Exam score!