Contact Us : 800.874.5346 International: +1 352.375.0772

An Enrolled Agent credential is the most prestigious status awarded by the IRS. An EA designation distinguishes tax professionals from other non-credentialed tax preparers, signaling a high level of expertise to clients, and allows them to have unlimited representation before the IRS. In this context, “unlimited representation” means EAs can work and communicate with the IRS on all matters regarding a client’s rights, privileges, and liabilities regardless of where their clients are located.

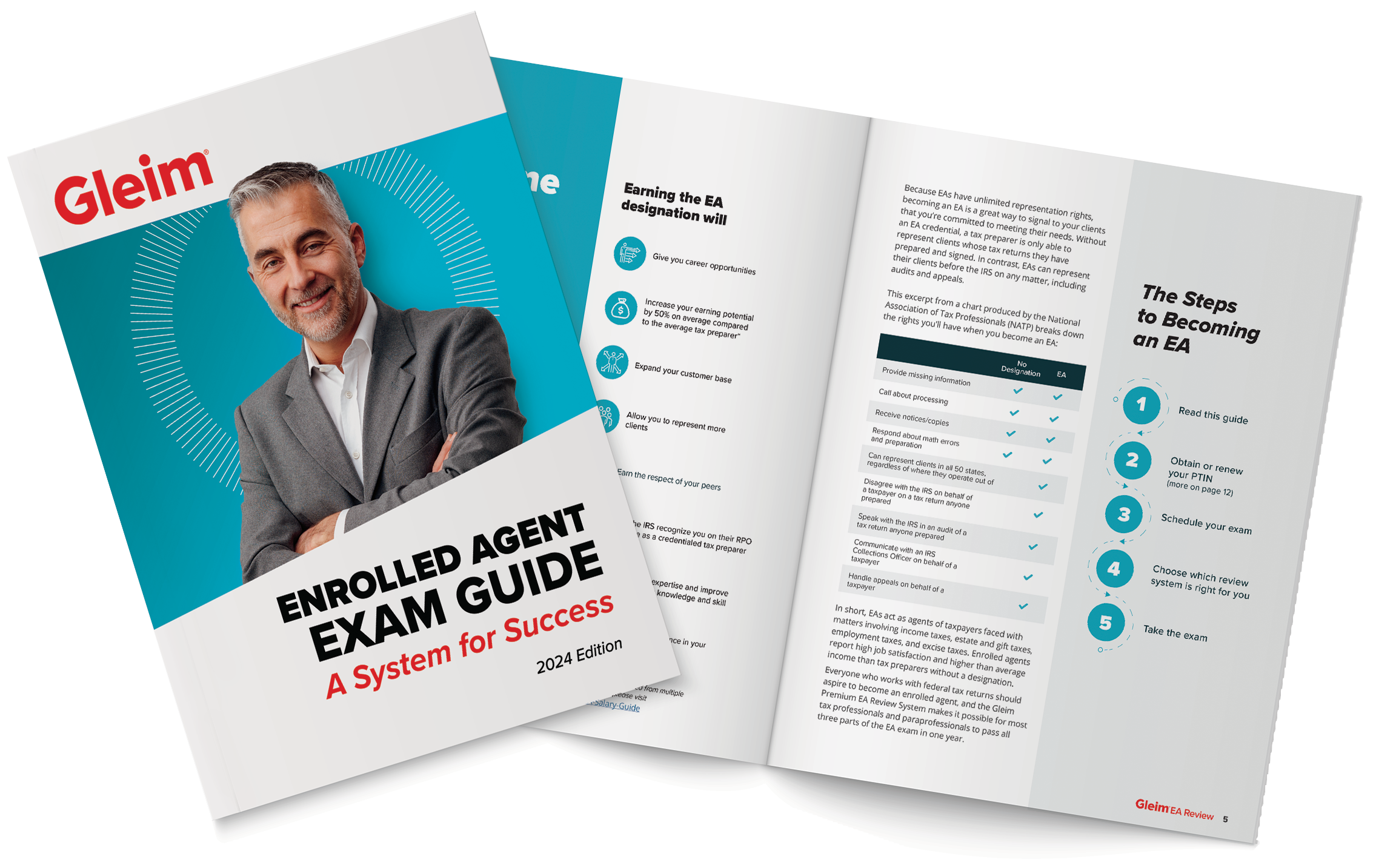

The Enrolled Agent credential expands a tax professional’s career horizons, granting benefits that could not be attained by that of an uncredentialled tax preparer.

Enrolled Agents are individuals that have passed the IRS Special Enrollment Exam (SEE) and completed all other requirements set out by the IRS. It is the highest credential awarded by the IRS.

The SEE, also known as the Enrolled Agent exam, is a comprehensive three-part test that tax preparers must pass in order to become an IRS Enrolled Agent.

Individually, the Enrolled Agent designation expands the number of services a tax preparer can offer, and EAs can expect to gain the following benefits:

Enrolled Agents also have many different career paths thanks to their designation, such as:

We’ve been helping candidates prepare for the EA since 1999, and we put our decades of experience into creating the ultimate EA guide—complete with all of our best advice. Sign up, get your copy, and learn everything you need to know before exam day, including:

The Enrolled Agent certification can be simplified into four major steps, and once these steps are completed, you will be awarded with your Enrolled Agent designation:

For more detailed info on each step, visit our How to Become an Enrolled Agent page!

The Enrolled Agent exam consists of three distinct parts, each testing a different section of a variety of tax topics:

Within each exam part, there are major topics the IRS calls “domains.” The IRS releases an “Exam Content Outline” detailing these domains and the content tested in them, which our team of accounting experts uses to make sure our course covers everything you need to know to pass the exam.

To find out exactly what each EA exam Part covers, check out our breakdown on our About the EA Exam page here.

Ultimately, how long it takes to obtain Enrolled Agent status will come down to the study schedule you create and how strictly you stick to it, but one year is an attainable goal for most people.

We have prepared EAs for 25+ years, and based off of average study times we have found that tax professionals study for about 10 hours a week for 7 – 8 months, or 235 – 265 hours total. This means that you can easily become an EA in between tax seasons, making it so you can earn your credential before the next busy season.

For a more in-depth look, visit our “How Long Does it Take to Become an Enrolled Agent” blog here!

Find out how you will do on the exam with our free EA Questions.

Learn exactly where you stand on each topic and review our answer explanations for every question!