Contact Us : 800.874.5346 International: +1 352.375.0772

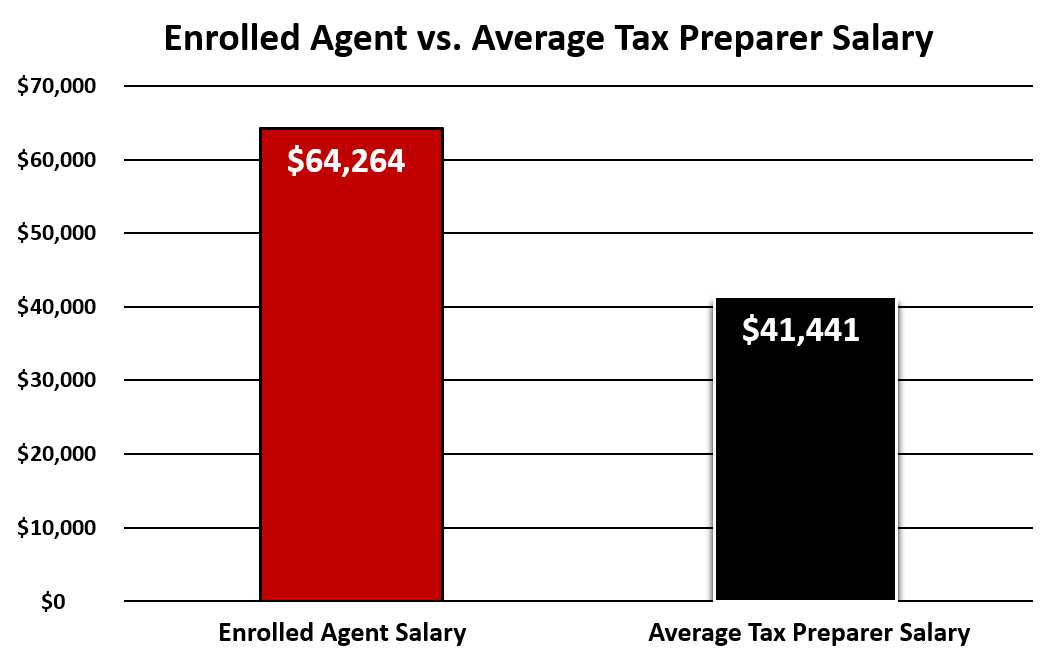

The average Enrolled Agent salary in the U.S. is $64,264, while the average Tax Preparer Salary in the U.S. is $41,441 according to top salary reporting databases*. This is a difference of $22,823, or an increase of 55% annually for credentialed Enrolled agents, making an EA credential the fastest way to increase your salary as a tax preparer. Here we’ll break down how much Enrolled Agents make throughout each stage of their career and cover how you can increase your earnings.

The average tax preparer salary is $41,441. Entry-level tax preparers make less, but can expect their salary to increase after gaining several years of experience, and gathering more clients.

If you’re looking to speed up your salary gains in tax preparation, the best thing you can do is earn a professional designation, like the Enrolled Agent designation awarded by the IRS. Earning an EA confirms to clients the tax knowledge that you have, and keeps you up to date every year on any changes in taxation.

This in turn makes you a more popular choice compared to your peers when it comes to a potential client looking for a tax professional.

Many different things add up to give you the dollar amount you see on your offer letter or paystub—things like your experience level, job title, company size, and location, as well as any relevant certifications you have. This is good news because it means you’ve got options when you’re looking for ways to increase your salary! Here’s how the major salary factors break down, plus our advice for making the most of your tax preparer or tax accountant career. The best ways to increase your salary are to:

The biggest step you can take to increase your salary as a tax preparer is to become an Enrolled Agent. Earning the EA designation can add the equivalent of years of experience to your resume, and will boost your average annual salary by enabling you to take on more clients in the case of a tax preparer.

Another way to boost your salary and solidify your expertise is to become dual-certified. Whether you’re just getting started as an Enrolled Agent or are already a CPA wanting to specialize in tax, dual certification is the best way to help yourself stand out from the crowd.

A smaller step, but still one in the direction of earning more for your expertise, is completing the Annual Filing Season Program. The AFSP is a yearly 15 to 18 hour continuing education program governed by the IRS. Once completed, you are listed on the IRS’ RPO database as an official “Annual Filing Season Program Participant”.

This in turn provides better visibility for you as a tax preparer, more services from what you have learned, and implicit trust for your present and future clients that they are in the right hands when choosing you to do their taxes.

Completing the AFSP is not nearly as comprehensive as receiving an Enrolled Agent designation, and you do not have as many rights as an EA. However, it is vastly cheaper than that of preparing and sitting for the EA exam, and takes much less time to complete.

If you’re applying for your first tax preparation job, your experience includes your education and any relevant extracurricular activities you participated in (such as the IRS’s VITA program). Once you get your first job, experience starts to include actual time working in the industry and your accomplishments at work.

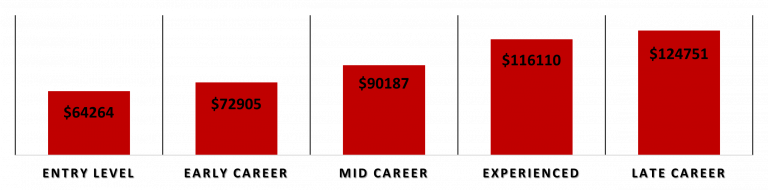

As you progress in your career, your salary will naturally increase. For each stage of your Enrolled Agent career, you’ll see an average salary increase of 8.38%.

Becoming an Enrolled Agent is a credential, and while it can be used to gain more clients at a tax practice, it can also help unlock other career paths in corporations. While not all of these jobs require someone to be an Enrolled Agent, the expertise shown by acquiring an EA credential is valuable, both for the company and personally, in any position that requires a high level of tax knowledge. Popular jobs within the tax field include:

Large firms are willing and able to pay a premium to attract top talent. The larger the company, the higher the pay for a given role, and the better defined your career path will be.

The most highly specialized Enrolled Agent probably isn’t going to be earning as much at a smaller organization as they could at a larger one. Some larger organizations pay their entry-level Enrolled Agents more than smaller organizations pay experienced Enrolled Agents.

It’s difficult to give a dollar value to other forms of compensation, but it’s important to consider them. Compensation and company culture vary wildly across employers, but similarly-sized organizations tend to have a few things in common:

Small Organizations

Offer more flexibility and greater access to management, giving individuals a greater say in the perks and fringe benefits available.

Large Organizations

Offer some benefits (e.g., gyms, cafeterias, and daycare) that smaller firms can’t reasonably fit into their budgets.

Big 4 Accounting Firms

If your goal is to work at one of the Big 4 accounting firms, the Enrolled Agent designation is one way to stand out from other applicants. Learn how becoming a tax expert can help you excel at firms of all sizes on our Enrolled Agents at the Big 4 blog.

It’s really a personal choice what size company you want to work for, but you should consider benefits that can affect your quality of life.

For example, daycare can be a considerable expense for young working families. On-site daycare could save thousands of dollars and dozens of hours in commuting each year. At the same time, some people dislike the bureaucracy that comes with larger organizations, and they’re happier at the end of the day if they have more freedom to pursue their own ideas.

According to the 2024 Robert Half Salary Guide, hiring trends in accounting and finance continue to favor the job candidate. Firms are looking to fill entry-level positions, so recent accounting grads and young professionals are in a great position to get their first accounting job. Firms are especially interested in candidates with technology skills that can be applied to growing areas like cloud systems and data analysis. Managers are looking for new ideas and are prepared to provide the necessary on-the-job training to prepare new hires for success. This is a great time to go into accounting, and becoming an Enrolled Agent will help you land an even bigger starting salary than you could without it.

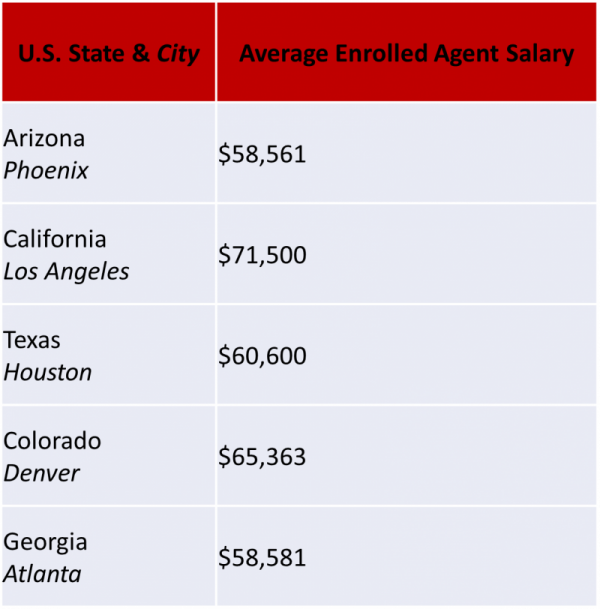

Mostly, the bigger the city the higher the median EA salary. Big cities have more job opportunities and a larger pool of skilled workers, but they also typically have a higher cost of living, so location isn’t everything. If you dislike the cold and aren’t comfortable in a big city, you don’t have to live in New York or Chicago to make a living as an Enrolled Agent.

Find a place you want to live or a firm you want to work for and then use the table below to inform your salary expectations.

Becoming an EA is one of the best investments you can make in your career as a tax preparer. The benefits you’ll gain from earning the EA designation will far outweigh the cost of taking the EA exam. In addition to the salary benefits, you’ll also enjoy increased representation rights so you can expand your client base and the services you can offer. Plus, the EA designation signals a high level of expertise that will cement your status as a valuable expert on tax topics.

*Data gathered from Indeed, ZipRecruiter, Glassdoor, and Salary.com by searching “Enrolled Agent” salaries, and “Tax Preparer” salaries