Contact Us : 800.874.5346 International: +1 352.375.0772

CPA Exam news comes from many sources. Gleim will help you keep up with all the news and announcements on the CPA Exam.

Stay up-to-date on all the latest updates for the CPA Exam, and learn what the headlines mean for CPA candidates.

Earlier this week, NASBA and the AICPA announced a new program granting eligible candidates an extension of their previously-expired CPA Exam credit. The goal of the Credit Relief Initiative is to help any CPA candidates adversely impacted by the disruption of testing centers during the pandemic.

If your credit for one or more CPA Exam sections expired between 1/30/2020 and 5/11/2023 and your state board has adopted NASBA’s CBT Administration Committee’s recommendation, you may be eligible to have that credit’s validity extended through 6/30/2025. Candidates who have already replaced their expired credit cannot benefit from this program.

Each state board must approve and adopt the Credit Relief Initiative individually. Some may choose to adjust the recommended date ranges and other may choose not to adopt the initiative, so be sure to check with your state board for details when they become available.

Discussions about the initiative are slated to continue at state board meetings this fall, and FAQs from NASBA are forthcoming. Additionally, an interest form should be available soon that interested candidates can use to apply for credit relief. If you have questions, contact your state board or email NASBA at cri@nasba.org

We’ll keep you updated as more information becomes available. Don’t miss this special opportunity to get back your expired CPA Exam credit!

We’ve said it before and we’re saying it again: Take BEC in 2023.

NASBA recently published a chart that details exactly when candidates must apply by to take BEC. Details for every state are available below, and NASBA will be posting more information soon on their website.

BEC is widely considered the easiest section of the CPA Exam, so whether it’s your first section or your fourth, there’s no reason to skip BEC in 2023. Most first-timers must apply by October 1, 2023, but there is some variation depending on which jurisdiction you’re applying in (see chart below).

Our Personal Counselors are here and ready to help you if you’re unsure where to start. We want to see you succeed, which is why we highly recommend passing the easiest section of the CPA Exam while it still exists. There’s still time to earn your credit if you start now, and you’ll get to skip the new Disciplines coming with CPA Evolution.

NASBA just shared critical info for anyone planning to take the CPA Exam at the end of next year and beyond. All of the dates mentioned below are subject to change, but they’re extremely important to be aware because they may affect your plans.

You won’t be able to take BEC at the end of 2023.

The last day to sit for AUD, FAR, and REG before CPA Evolution is December 15, 2023!

That means if you pass all four sections of the CPA Exam before December 15, 2023, you shouldn’t be affected by any of the other content or administration changes.

The CPA Exam will not be offered between December 16, 2023 and January 9, 2024, so that testing centers can get ready to administer the 2024 CPA Exam.

The new exam, with all of the CPA Evolution changes, will be offered beginning January 10, 2024.

The Boards of Accountancy are considering extending credit for any passed sections that candidates have on January 1, 2024, to June 30, 2025.

Boards of Accountancy are also considering changing when the 18-month rolling window for CPA Exam credit begins.

Learn more about CPA Evolution and the transition policy.

Check out NASBA’s FAQ about CPA Evolution, the transition policy, and more.

On June 28, 2022, the AICPA released an Exposure Draft (ED) that contains tentative CPA Evolution Blueprints for public comment. Learn what’s coming on our CPA Evolution Update page!

We met with the AICPA on Tuesday where they shared the infrastructure changes coming to the CPA Exam on January 1, 2024, because of CPA Evolution.

Here are the highlights:

For more information, check out AICPA’s announcement.Opens in new window

CPA Evolution is coming January 2024, and NASBA today announcedOpens in new window their transition policy for CPA Candidates.

NASBA’s goal is to ensure that CPA candidates are not penalized for exam sections already passed within their 18-month window and that exam costs are not increased.

If you’re just starting to think about earning your CPA, you may find yourself starting your exam under the model and finishing under CPA Evolution. Check out our CPA Evolution Update to find out how it will affect you!

NASBA announced they have expanded available locations to test for the CPA Exam in East Asia. The Republic of Korea is now available for testing for some countries, and the number of countries that can test in Japan will increase.

From NASBA:

“ To support you on your pathway to CPA licensure, we are now extending administration of the Exam in the Republic of Korea and Japan on a permanent basis to all eligible candidates . . . .

Qualified candidates may schedule to take any U.S. CPA Exam section in Japan or the Republic of Korea. CPA candidates may also schedule their Exam sections at the Guam Prometric Test Center as it remains open and available for testing.”

We’ll keep you posted on any additional changes as they are announced.

To test in Japan or the Republic of Korea, candidates must be deemed eligible and have valid citizenship or long-term residency in the following countries:

If you are interested in sitting at an international testing center, you must pay an examination administration fee before scheduling with Prometric. You can do so through your NASBA CPA Candidates Account portalOpens in new window by selecting “International Administration.”

On Saturday, August 21, from 8 a.m. to 5 p.m. CST, NASBA’s Gateway and CPA Central systems will be down for scheduled maintenance. CPA Exam candidates will not have access during this time.

If you are scheduled to take the CPA Exam during this time, please print or download your Notice to Schedule (NTS) form before the scheduled outage. If you do not have your NTS, you will not be able to test.

If you were emailed your NTS, be sure to save it and print it out as a backup.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

UPDATE: As of August 13, 2021, Prometric will continue to require all test takers to bring and wear a mask during the entirety of their time at the test center or their exam will be terminated.

Beginning August 2, 2021, Prometric will begin returning to or amending standard operating procedures that were in place prior to the pandemic or created as a result of the pandemic. This return to normal will be implemented in phases.

Note: Should government guidance regress and become more restrictive, Prometric will realign its procedures with government restrictions to ensure the safety of candidates and test center staff.

Over the coming weeks and months, candidates are encouraged to visit Prometric’s COVID-19 Updates Opens in new window page, Test Center Policies Opens in new window, What to Expect Opens in new window, and FAQ Portal Opens in new window often for the latest test procedure updates. We will also keep you updated so you can focus on taking and passing your exams!

Phase I will include the following procedural changes:

Additionally, Prometric will re-implement various standard procedures (where allowed) during Phase I, resulting in the following updates to its test center operations:

Phase II of Prometric’s return to modified test center operations will include the following:

While Prometric is requiring face coverings, in some states, executive orders prohibit government agencies and institutions of higher education, respectively, and their officials from mandating face coverings or restricting activities in response to the COVID-19 pandemic. Where Prometric operates test centers on state university campuses where these policies have been enacted, we follow local mandates where they allow candidates to test without a mask. In these sites, candidates will still be allowed to wear masks according to their comfort level at these sites, but masks will not be mandatory.

Both medical masks or cloth face coverings are acceptable. Masks with exhale/one-way valves are prohibited to use at the testing center, due to the lack of viral particle filtration provided by these masks. Any test taker that comes to the test center without a mask will not be allowed to test, marked as a “no show,” and will not be eligible for a free reschedule.

The full announcement from NASBA can be found on their blog Opens in new window, and additional information can be found on Prometric’s COVID-19 FAQ Opens in new window. As usual, we will continue to keep you updated as new information is announced.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

The CPA Exam started Continuous Testing on July 1, 2020. Plans for the new testing model were originally announced last May, and more information about its accelerated implementation will be coming in the next few weeks.

Continuous Testing functions just as it sounds. The CPA Exam will no longer be offered four times a year during testing windows. Beginning July 1, candidates can test year-round. This change helps CPA candidates pass the CPA Exam faster and reduce the risk of losing credit for sections due to time constraints.

Candidates who fail an exam section will be able to retake that section as soon as they get their new NTS. No more waiting for another window!

As of August 6, 51 jurisdictions have already implemented Continuous testing. NASBA expects an additional two jurisdictions to do so later this year. Only one board (South Carolina) is not expected to offer Continuous Testing until 2021.

The states and jurisdictions below have implemented Continuous Testing as of July 1. We will update this list as more information becomes available.

Only South Carolina is still preparing and fully expected to enact Continuous Testing. We will update this list as more information becomes available.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

In response to the ongoing COVID-19 pandemic, NASBA and the AICPA will administer the U.S. CPA Exam in Canada at approved Prometric test centers until further notice. This has been extended from the previous deadline of June 30, 2021.

Canadian candidates may schedule to take any U.S. CPA Exam section in approved Prometric test centers in Canada. You can find available testing centers and appointments through Prometric’s Seat Availability Tool.

Note: All eligible CPA candidates wishing to take the U.S. CPA Exam in Canada must review and acknowledge the informed consent documentation. You can acknowledge your informed consent through an electronic form.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Beginning June 7, 2021, Prometric will reinstate fingerprint and ID scans in all test centers. Biometric procedures were suspended last year due to the pandemic, but after an updated review of test center safety protocols with Johns Hopkins University, they will be reinstated with the following additions:

To complete an ID scan, candidates will need to briefly lower or remove their masks. Per Prometric, “to help ensure social distancing is still maintained, test center staff have been trained on how to assist test takers in using fingerprint scanners and ID scan from an appropriate distance.”

View the latest Prometric Test Center PoliciesOpens in new window.

If you have questions or concerns, the NASBA Examinations Team encourages you to contact them at cpaexam@nasba.org.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

NASBA announced that they have expanded available locations to test for the CPA Exam in the Middle East. Prometric test centers in Tel Aviv, Israel, and in Riyadh, Jeddah, and Khobar, Saudi Arabia, will administer the CPA Exam starting May 5, 2021.

To test in Israel and Saudi Arabia, as well as other Middle East countries where testing is already available, candidates must be deemed eligible and have valid citizenship or long-term residency in one of the following countries:

To test in an international location, you must first select a participating U.S. jurisdiction, contact the Board of Accountancy (or its designee) in that jurisdiction to obtain application materials, and submit a completed application and required fees as instructed. After receiving the Notice to Schedule (NTS), you may then use the NTS to apply to take the Exam in an international location.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

As we approach the December 31, 2020, expiration for many CPA Exam credit and NTS extensions, some state boards are making adjustments. A handful of states have extended CPA Exam credit expiration to March 30 or June 30, 2021, but there have not been any updates to NTS extensions at this time.

Check our Coronavirus update page and the NASBA NTS and exam credit extension resources for updates. Contact your state board of accountancy with any questions about NTS extensions, exam credit extensions, or other issues related to the COVID-19 pandemic.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

The AICPA has just released a Final Report based on the Practice Analysis they conducted in 2019, alongside changes to the CPA Exam Blueprints effective next summer. The sections most heavily affected are AUD and BEC. These changes are to ensure newly-licensed CPAs are able to perform the duties assigned to them.

The CPA Exam continues to assess higher-order skills, including critical thinking, problem-solving, and analytical ability. There are no changes to score weighting, testing time, or the number of CPA Exam questions.

The changes to AUD and BEC are as follows:

AUD content weighting changes

AUD skill weighting changes

BEC content weighting changes

These changes will not be tested until July 1, 2021, so you still have time to pass the affected sections if you start now. More questions in AUD will test you at a higher level, so AUD will definitely get more difficult. It’s a good idea to try to pass AUD before the changes go live.

The changes to BEC appear relatively minor, but just in case, we recommend taking it now if you have time. With Continuous Testing now available, getting started today will ensure you have enough time to take both sections before July 1, but if you have to pick one, we recommend passing AUD first.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Earlier this year, the AICPA, NASBA, and Prometric announced the CPA pilot test in India. Despite the challenges presented by the COVID-19 (Coronavirus) pandemic, the test has received very positive feedback, so they are expanding the program to allow for Continuous Testing, a new testing model that began to be adopted in July of this year.

The AICPA, NASBA, and Prometric are bringing Continuous Testing to India starting January 1, 2021, but candidates may begin to use the scheduler now. Continuous Testing will replace the existing limited CPA Exam Testing Window model, which only permits candidates to test in India during designated periods. Under the Continuous Testing model, candidates have the ability to schedule to take CPA Exam sections at any time with two minor restrictions:

All of the U.S. Boards of Accountancy support the move to bring Continuous Testing to India, as it positions candidates to retake sections while the information is still fresh in their mind and may reduce the time needed to complete all four sections of the CPA Exam.

Before scheduling your exam in India, ensure that your state board already transitioned to the Continuous Testing model. Several Accountancy Boards have not yet shifted to Continuous Testing and still operate under the old Testing Window model, which only allows candidates to sit for each section once per calendar quarter.

For more information on Continuous Testing, check out this new blog post!

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

NASBA is expanding available testing locations for the CPA Exam in the Middle East. Testing will be available in both Egypt and Jordan effective November 2, 2020.

From NASBA:

“Starting October 26, 2020, qualified candidates may begin applying to take any section of the U.S. CPA Exam under the Continuous Testing model. Candidates may also begin scheduling their Exam with Prometric on November 2, 2020.”

To test in Egypt and Jordan, as well as the other Middle East countries where testing is already available, candidates must be deemed eligible and have valid citizenship or long-term residency in one of the following countries:

If you are interested in sitting at an international testing center, you must pay an examination administration fee before scheduling with Prometric. You can do so through your NASBA CPA Candidates Account portal by selecting “International Administration.” For specific questions concerning international testing, candidates can reach out to NASBA at cpaexam@nasba.org.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Since the pilot test began June 1, over 600 candidates have sat for the CPA Exam in India. There are over 1,000 candidates currently registered for September, and more are expected to register in the coming weeks.

Due to this success, and to make it easier for candidates to test during the COVID-19 pandemic, the AICPA has expanded testing to December 1 through December 31. The AICPA has already begun notifying candidates they may begin scheduling their exam for this period. Originally, candidates were only able to test in June and September 2020.

The AICPA is asking candidates who have participated or who wish to participate in the pilot to fill out a survey, which will help the AICPA decide where and how to administer the exam in the future.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

In March, Prometric waived all cancellation and rescheduling fees for the CPA Exam due to the COVID-19 pandemic. Beginning August 1, 2020, these fees will be reinstated.

Prometric is still working to assist candidates in areas impacted by the pandemic.

Candidates who have appointments canceled or rescheduled as a result of continued test site closures or regional restrictions will not be penalized. If your exam appointment is impacted due to site closures or regional restrictions, you will receive an email notification informing you that your appointment has either been

Candidates who are unable to test due to COVID-19 illness or impact after August 1 should contact Prometric using their “Contact Us” form and choose “Request a Refund.” Prometric will respond to you individually. Because of the high volume of inquiries they are receiving, they estimate it will take between 5 and 7 days for you to receive a response.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Continuous Testing will begin July 1, 2020, and as a result, the timeline for when CPA Exam scores are released has changed.

The target dates below may be changed or delayed by your state board.Scores for the BEC exam may be delayed for human review as well. Be sure to check NASBA or your state board frequently if you are expecting a score but have not yet received it.

| If you take your exam on/before: | Your target score release date is: |

|---|---|

| July 23 | August 7 |

| August 16 | August 25 |

| September 8 | September 16 |

| September 30 | October 9 |

| October 23 | November 10 |

| November 16 | November 24 |

| December 8 | December 16 |

| December 31 | January 12 |

This information allows candidates to plan their studies and scheduling of their exams. With Continuous Testing, candidates can reapply for an exam as soon as they know their score from the previously unsuccessful attempt.

While it can be tempting to sit for your exam as close to the cut-off date as possible, since you will only have 18 months to pass all four exams, Gleim still recommends candidates sit as soon as they feel comfortable doing so. You can read more scheduling strategies on our CPA Resource Center.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

As most of the world begins to reopen and rebuild in the wake of the COVID-19 (Coronavirus) pandemic, state boards are starting to meet, either in person or virtually, and make decisions regarding the CPA Exam. So far, most states have announced their plans to help candidates affected by Prometric closures, and more are expected to follow.

Most states are granting extensions with no action required by CPA candidates. If you have questions, contact your state board directly.

Gleim will update this list as more information becomes available. Check NASBA’s Exam Credit Extension or our COVID-19 update page for the most recent updates.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Many states have elected to extend candidates’ NTSs beyond September 30, 2020, the date originally announced in March by NASBA. Check the charts below, NASBA’s NTS Extensions page, and our COVID page for updates.

| States and territories with additional extension If your NTS would expire April 1, 2020, to December 30, 2020, it is valid until December 31, 2020. | |||

|---|---|---|---|

| Alabama | Guam | Nevada | South Dakota |

| Alaska | Hawaii | New Mexico | Tennessee |

| Arizona | Illinois | New York | Texas |

| Arkansas | Iowa | North Carolina | Utah |

| California | Kansas | North Dakota | Vermont |

| Colorado | Kentucky | Ohio | Virginia |

| Connecticut | Louisiana | Oklahoma | Washington |

| Delaware | Minnesota | Pennsylvania | West Virginia |

| District of Columbia | Mississippi | Puerto Rico | |

| Florida | Missouri | Rhode Island | |

| Georgia | Montana | South Carolina | |

| States and territories with original extension If your NTS would expire April 1, 2020, to June 30, 2020, it is valid until September 30, 2020. | ||

|---|---|---|

| Indiana | Michigan | Oregon |

| Maine | Nebraska | Virgin Islands |

| Maryland | New Hampshire | Wyoming |

| Massachusetts | New Jersey | |

Idaho is the exception. On April 28, 2020, the Idaho Board sent a Proclamation to candidates stating Board staff will be providing 90- to 180-day extensions as needed, and any extensions beyond 180 days will require board ratification. This provision will be discussed at the next Board meeting on June 4, 2020, and continued or expanded if necessary.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Prometric is continuing to watch the impact COVID-19 is having on their testing centers and is releasing new information as it becomes available. Prometric has monitored, and will continue to monitor, information provided by global health organizations, local governmental policies, corporate policies, and input from testing partners and candidates.

Test centers will be evaluated for closure on a case-by-case basis.

Prometric has reviewed and reinforced policies to mitigate the risk of spreading the virus at test centers. This includes ensuring surfaces and devices that are commonly touched by customers (such as keyboards, computer mice, biometric touch chip devices) are regularly cleaned and sanitized.

Prometric will also provide disposable wipes and allow candidates to use medical masks and gloves while testing. If you do choose to use a mask or gloves, note that test center staff may need to visually inspect these items.

Regardless of your current exam schedule, you will want to make sure you protect yourself and those around you from the virus.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

Safety precautions that restrict travel are making it difficult for international candidates to sit for the CPA Exam. In response to candidate concerns, NASBA has announced plans to administer the exam at many Prometric Test centers in India.

Starting today, candidates eligible to sit in India can schedule their exams for June or September of 2020. Testing is currently limited to these months as a trial. If, due to the Coronavirus, Prometric Test Centers have not reopened by that date, NASBA and Prometric will reevaluate. No information is available at this time about plans to open these centers for testing after September.

Gleim will keep you updated.

The CPA Exam will be available at India test centers in the following eight cities:

If you have already paid the international administration fee for another region and wish to switch to India, email NASBA at iexam@nasba.org with the following information:There is an international administration fee due before you are able to schedule with Prometric. Log into your NASBA CPA Candidate Account portal, select “International Administration,” then select “India” to proceed.

To take the CPA Exam in India, you must be an eligible CPA Exam candidate and a citizen or a long-term resident of one of the following countries:

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

To provide candidates with additional testing opportunities,NASBA, the AICPA, and Prometric have opened an emergency testing period. The 2020 Q2 testing window is being extended from June 10, 2020, to June 30, 2020.

Additionally,

There is no need to contact your State Board at this time.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

In 2019, the AICPA conducted a Practice Analysis of the CPA profession. It explored the impact that technology had on the CPA profession and determined areas where the CPA Exam could be updated to better tests those skills. This article will discuss the findings of the AICPA 2019 Practice Analysis and what changes you can expect on the CPA Exam over the next two years.

NOTE: None of the proposed changes have been finalized yet. All of the information in this article is subject to change as the AICPA further refines their plans for the CPA Exam.

According to the Practice Analysis, the following dates are important to keep in mind:

April 2020 – New CPA Exam Blueprints to be released

October 2020 – Heavier emphasis on Excel and Data Analytics to be tested in AUD

January 2021 – New CPA Exam Blueprints are expected to show the changes from the Practice Analysis

July 2021 – Changes from the January CPA Exam Blueprint to take effect

2022 – Written communications removed from BEC and State and Local Government topics removed from FAR

Candidates can largely be split into two groups for these changes: those who intend to test before these changes take effect and those who will test afterwards. Regardless of which camp you fall into, Gleim is here to help.

|

Taking the CPA Exam Before It Changes (Recommended) |

Taking the CPA Exam After It Changes |

|---|---|

|

|

Based on the findings of the AICPA, technology and data analytics are becoming even more present in today’s accounting world. This means that CPAs are increasingly called upon to make use of modern tools and data. As a result, the AICPA must ensure that the CPA Exam is adequately testing what entry-level CPAs are expected to know to be prepared to meet the industry’s needs and the expectations of their employers.

To learn more about why the CPA Exam changes, visit our CPA Exam Changes page.

A practice analysis is a study conducted on the current positions that CPAs fill and the expectations placed upon them. Every few years, the AICPA works with industry leaders and practicing CPAs to see what the current trends in accounting are and to determine how the organization can best adapt to meet those trends.

NOTE: The results of a Practice Analysis are not always definitive and often take time to implement. The CPA Exam is likely not changing significantly until July 2021.

No changes have been finalized yet. The AICPA released an exposure draft and will be collecting comments until April 30th. These comments will then be factored in before any changes are officially announced.

However, based on the current draft, we can see a few possible changes that may be coming in the future:

The AUD and BEC sections of the CPA Exam will likely receive the greatest impact from the technology and data analytics changes.

These changes will focus on ensuring newly licensed CPAs are digitally focused and able to understand business processes, automation, risks, and internal controls.

Furthermore, the changes will likely include a greater emphasis on data analytics, which could become effective as early as October 2020.

Written communications could be removed from BEC.

Data management, governance, and data relationships will likely be added to BEC.

The FAR section of the CPA exam could see IFRS and State and Local Governmental topics removed.

The CPA Exam will likely have a greater emphasis on Systems & Organizations Controls (SOC 1) reports.

The Task-Based Simulations will likely make heavier use of Excel, especially in AUD.

Candidates will be expected to be able to sort, filter, and compare data sets in Excel.

While no changes have been firmly announced, some changes will likely be coming in late 2020. The first thing to be on the lookout for are the new CPA Exam Blueprints. The CPA Exam Blueprints provide an overview of the topics that the AICPA will test on the CPA Exam. The new blueprint is set to be released in April 2020.

NOTE: The CPA Exam Blueprints do not take effect immediately on release. The changes detailed in the blueprint will not be testable until the effective date indicated on the blueprint.

Gleim will always work to keep you informed on all CPA Exam news. You can follow us on Facebook to get the latest news as it is announced. In addition, if you’d like to read over the complete 2019 AICPA Practice Advisory, you can get a PDF copy of it (for free) from the AICPA.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

NASBA has announced that candidates who are unable to travel to their CPA Exam testing site because of the travel restrictions imposed due to the Coronavirus are eligible to receive an extension to their Notice to Schedule. NASBA and Boards of Accountancy will treat each request on an individual basis.

Just like normal Exception to Process (ETP) procedures, if you are scheduled for an appointment, you will need to cancel that appointment before submitting the ETP form.

If your state board of accountancy’s NTS extensions are managed by NASBA, you can find the required form online at nasba.org by selecting the form section under each specific state’s examination page. NASBA manages the NTS extensions for the following state boards of accountancy:

If your state board of accountancy’s NTS extensions are not managed by NASBA, you will need to contact your board of accountancy directly.

Candidates may contact NASBA at cpaesrefund@nasba.org for more information.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

The AICPA announced that beginning on February 1, 2020, more CPA candidates will be eligible to test at CPA testing centers in Europe.

| Before February 1, 2020 | Beginning February 1, 2020 |

|---|---|

| Only U.S. citizens living abroad and citizens/residents of England, Germany, Ireland, Scotland, Norway, Switzerland, Russia, and other European nations could test at the testing centers in England, Germany, Ireland, and Scotland (no other European testing centers were allowed). | Anyone who is eligible to test at a U.S. testing center is now eligible to test at the testing centers in England, Germany, Ireland, and Scotland (no other European testing centers are allowed). |

The CPA Exam has eligible testing centers in England, Germany, Ireland, and Scotland. Any testing center approved to administer the CPA Exam is also eligible to administer the IQEX exam.

Previously, these testing centers were only eligible to U.S. citizens living abroad and citizens/residents of England, Germany, Ireland, Scotland, Norway, Switzerland, Russia, and other European nations.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

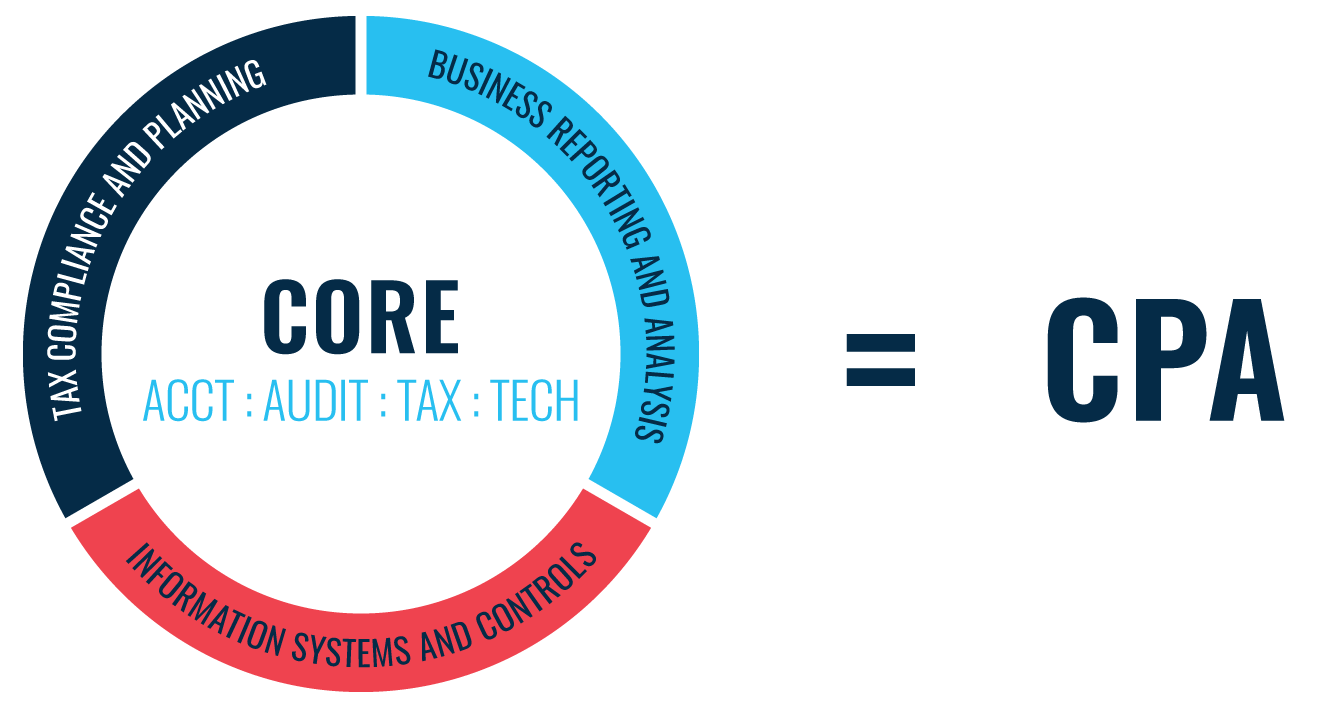

The National Association of State Boards of Accountancy (NASBA) and the American Institute of CPAs (AICPA) have proposed a new CPA licensure model. This new model is designed to ensure that newly licensed CPAs have the knowledge and skills needed to fit the changing demands placed on them.

NOTE: These changes are still under development. While NASBA and the AICPA hope to finalize the plan by Summer 2020, it will be implemented over several years.

The new draft is based on feedback from over 2,000 stakeholders (including AICPA members, firms of all sizes, academics, regulators, state societies, and technology experts). Based on their feedback, NASBA and the AICPA identified these themes:

There is support for changing the CPA licensure model to have a bigger emphasis on technology skills and knowledge.

Newly licensed CPAs should demonstrate strong common core competencies of accounting, auditing, tax, and technology.

Technological expertise should be required for licensure, but there are also other factors disrupting the profession.

The revised model should be about maintaining the strength and relevance of the CPA to ensure continued public protection.

U.S. Boards of Accountancy, as regulators, must remain relevant to protect the public we serve. Today’s marketplace is shifting, and CPAs need new skills to continue to serve organizations and the public. We need to ensure that CPAs continue to have the competencies needed to support an accounting profession that plays a critical role in protecting the public interest.

The model’s requirements start with a strong core in accounting, auditing, tax, and technology. This standard must be met by all CPA candidates. Each candidate will also choose an additional discipline to demonstrate deeper skills and knowledge in. Regardless of the discipline selected for testing, a CPA will still receive a full license; they would not be limited to their selected discipline.

The three disciplines that NASBA and the AICPA have identified are:

Tax compliance and planning

Business reporting and analysis

Information systems and controls

According to NASBA and the AICPA’s announcement, the proposed model will:

Produce candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms and the public;

Reflect the realities of practice by requiring candidates to demonstrate deeper knowledge in one of the three disciplines that are pillars of the profession;

Be adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve; and

Result in one CPA license.

These changes won’t be implemented in the near future, but they do help indicate the skills and knowledge that industry leaders see as vital for future CPAs. If you’re already preparing for the CPA Exam, rest assured that the exam will not be changing anytime soon. Gleim will continue to keep you notified of all relevant news about the CPA Exam and how it may change in the future.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

The AICPA has released 140 free CPA Exam questions to the public. These questions are all former exam questions and indicate how the AICPA tests various topics on the CPA Exam.

The AICPA will not update these questions to reflect standard-setting or regulatory activity, so keep in mind that changes could cause these questions to become obsolete or incorrect. In addition, while these questions do indicate the correct answer, they do not include answer explanations.

NOTE: Gleim has released a free PDF with 20 of these AICPA questions, including answer explanations.

The AICPA’s released PDF will only be available until December 31, 2019.

| CPA Exam Section | # of Released Questions |

|---|---|

| AUD | 40 |

| BEC | 25 |

| FAR | 50 |

| REG | 25 |

Seeing how the AICPA tests certain topics is a valuable tool in your study preparations. After all, knowing what to expect on exam day is vital to ensuring you have a successful exam.

If you’re using Gleim, you’ll get even more value out of these questions after they’ve been added to our course. We add all AICPA-released questions to our test banks, and we go the extra mile to create top-notch answer explanations so that you can learn from your mistakes. In addition, we’ll keep these questions up-to-date, so you won’t have to worry about them becoming dated as standards and regulations change.

To see the AICPA-released questions, check out their PDF at the AICPA’s website.

To see answer explanations for 20 of the AICPA-released questions, check out Gleim’s AICPA-released questions PDF.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

In an important move for international candidates, NIES has relaunched their undecided jurisdiction evaluation. If a candidate chooses an undecided jurisdiction option, NIES will evaluate your education and provide you with the best options for applying for the CPA Exam or License.

The NIES will suggest up to three jurisdictions based on your education and the state’s residency and social security number requirements. If you do not fit the education requirements for any jurisdictions, the NIES will still list up to three jurisdictions and will note any requirements you do not currently meet.

This service does not use your work experience in making jurisdiction suggestions, so you will need to individually look over the suggested states to ensure they will meet your needs.

For international candidates, deciding which state boards to apply to is a daunting task. Many states have residency or identification requirements that are difficult for international candidates to meet. In addition, some states do not have these requirements prominently displayed, and with 55 jurisdictions, international candidates have to do a lot of searching to find the best ones.

The NIES undecided jurisdiction allows international candidates to get a short list of good states to look at more closely. Plus, the information comes straight from NASBA, a reliable source.

NIES is an education verification service for international CPA candidates. Many state boards require candidates who received credit from an international university or college, including study abroad, to have their education verified. While some states allow other evaluation services, the NIES is the most used service for most state boards.

To learn more about the NIES or to make use of this outstanding service, visit the NIES’s website.

NOTE: An undecided evaluation does not create an official jurisdiction-specific report. Once you have decided on a jurisdiction, you will need to reapply for a jurisdiction-specific report. Doing so requires you to pay the application fee again.

If you’re looking for more information on the state boards of accountancy and their requirements, visit our free resource page which includes a list of the major requirements for all of the state boards.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

The AICPA and NASBA are working together to make significant changes to the CPA designation, but the changes will not take effect soon. The bodies have begun a new initiative called CPA Evolution. The goal of which is to ensure that the CPA exam and the CPA credential remain relevant in the ever changing business world.

We believe the earliest candidates could see changes is 2024, but it is more likely that the changes will take place after 2025 and most likely closer to 2030.

This initiative will not only have a large impact on the CPA Exam, it will change the requirements needed to become a CPA.

These changes are not being implemented in the near future. In fact, no deadline has been released. Historically, the AICPA has given significant notice before major changes have been implemented.

Current candidates and students should not worry about meeting these new requirements at this time.

Specific changes have not yet been released, but the AICPA and NASBA have released the following guiding principles and supporting concepts for this initiative.

In short, the new CPA requirements will focus more on technology. This will open the CPA designation up to people who do not have as strong of an accounting focus. It will not eliminate the accounting requirements, but some of the accounting requirements may lessen.

The accounting industry is changing rapidly. Clients and organizations demand services that require expertise in technical areas, and technological innovations continue to advance automation, data analytics, and artificial intelligence. These changes require CPAs to evolve to match their new working environment.

No specific dates for the changes have been set. We believe the most likely scenario is having changes implemented after 2025 and more likely closer to 2030.

The AICPA and NASBA are currently gathering information on their new core principles over the summer and will release the results at the 2019 NASBA Annual Meeting and AICPA Fall Council in October.

NASBA has released a post discussing the changes on their website.

The Journal of Accountancy has summarized the proposed changes in more detail in an article.

The North Carolina Association of CPAs also has released an article from the AICPA on the upcoming changes and how the changes are being designed.

Gleim will continue to follow this story and update you as new information becomes available.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

CPAs are getting a new domain extension to help establish an authentic presence online.

The AICPA announced it has been working with the Internet Corporation for Assigned Names and Numbers (ICANN) to create a new domain extension for CPAs and CPA firms (instead of the normal “.com”).

This new domain (.cpa) will be available to all CPAs and their firms. Once the new .cpa extension is released, firms will be able to register a new website URL (firmname.cpa) and CPAs will be able to use new email addresses (jdoe@firmname.cpa).

This new extension will signal to customers that your firm has a connection to the CPA profession and is in good standing with the AICPA.

By overseeing the .cpa domain in collaboration with other global CPA organizations, the AICPA can help promote CPAs’ visibility and protect their professional standing online.

No timeline for this change has been announced, but a mailing list for notifications has been created. Visit cpa.com/dotcpa to sign up for notifications.

Gleim will continue to follow this story and keep you informed about all developments.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.

NASBA announced that a significant change is coming to the testing windows for the CPA Exam.

CPA candidates will no longer be required to wait for another testing window to retake a failed section of the CPA Exam.

This rule is not yet in affect, as all state boards will need to make changes before it can be implemented.

The April 26 NASBA Board of Directors’ meeting cleared the path for continuous testing on the Uniform CPA Examination as the Board approved Uniform Accountancy Act Model Rule 5-7(a)(2). According to the revised Rule, when system changes have eliminated the need for test window limitations ‘a Candidate can retake a Test Section once their grade for any previous attempt of the same Test Section has been released.’ A recent informal poll of the State Boards’ executive directors found that many states have already started to model their rules after the new Model Rule. NASBA President Ken L. Bishop told the NASBA Board that plans now call for continuous testing to begin by June 30, 2020.

This ruling doesn’t mean that the CPA Exam will stop having blackout periods between testing periods. The improved technology that makes this change possible may also lead to a change to the blackout dates for the CPA Exam, but nothing has been announced.

The CPA Exam will still be offered for the normal testing periods:

EXAMPLE: Jane studies with a competitor, then takes and fails the AUD section of the CPA Exam on January 1.

With these new changes, candidates can schedule their CPA Exam early in a testing period and have enough time to retake the exam in that same period.

If you fail a section of the CPA Exam, be sure to apply for a new NTS as soon as you get your score. This will maximize your chances of being able to sit before a testing period ends.

The AICPA, NASBA, and Prometric all make changes to the CPA Exam. Keep up-to-date with CPA Exam news by following us on Facebook.

For a comprehensive look at all major CPA Exam changes, check out our CPA Exam Changes resource page. If you have any questions about how to apply for the CPA Exam, how hard the CPA Exam is, or any other CPA Exam topic, visit our CPA Exam Resource Center.

At Gleim, we know keeping current is vital for future CPAs. That is why all of our CPA Review materials are continually updated with the most recent information you need to know to pass the CPA Exam. If you’re ready to get the most up-to-date content with an Access Until You Pass® guarantee, look no further than the Premium CPA Review.