Contact Us : 800.874.5346 International: +1 352.375.0772

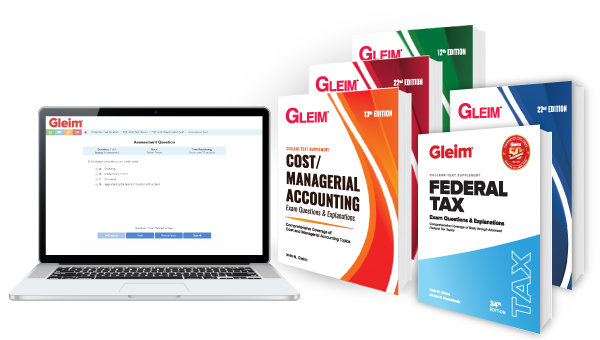

Gleim Exam Questions & Explanations (EQE) is an undergraduate series designed to supplement accounting courses and deliver students higher comprehension and increased test scores on college exams. Gleim EQE improves students’ study processes and tests their knowledge in an interactive environment using exam-quality practice questions.

Gleim offers EQE books and Test Prep libraries covering five major topics as well as cross-references from our EQE texts to major textbooks used in accounting classes.

Available EQE titles include:

Can’t find the cross-reference you’re looking for?

Let us know by filling out a Cross-Reference Request Form.

Have feedback on existing cross-references?

Send us your comments using our Feedback Form.