Contact Us : 800.874.5346 International: +1 352.375.0772

The Auditing and Attestation (AUD) CPA Exam section tests your knowledge of the entire audit process, as well as preparation, compilation, and review engagements and other non-attestation services. It also tests ethics, so you will have to become familiar with the AICPA Code of Professional Conduct.

To pass AUD, you’ll need to study diligently and take a lot of practice quizzes. The AUD section of the exam will be mostly conceptual: asking you to apply your judgment to questions about best practices, ethics, and proper procedure. So you’ll need to be able to comfortably put yourself in the shoes of an auditor in the field.

This guide will equip you with all of the information you need to prepare for the AUD section of the exam. If you’re already studying, check out some of our free webinars and videos or make use of our free test-bank of AUD questions. You’ll also find here some study tips specifically for AUD.

Contents

All about the Auditing and Attestation (AUD) CPA Exam Section

• What if I don’t have any auditing experience?

Why does the AICPA include pre-test questions on the AUD exam?

• What is a CPA passing score?

• Can I receive partial credit on Task-Based Simulations (TBSs)?

• When do new pronouncements appear on the CPA Exam?

AUD CPA Exam time management

How do I prepare for AUD?

• What is the best way to study for the AUD CPA Exam section?

Many accountants and accounting students don’t have any first-hand auditing experience when they decide to sit for the CPA Exam, so if this describes you, you’re not alone! Current auditors will have a head start, but it’s nothing that can’t be overcome with determined, disciplined studying.

Find a review course and stick to a study schedule, and you can be comfortably prepared to pass AUD in 10-12 weeks.

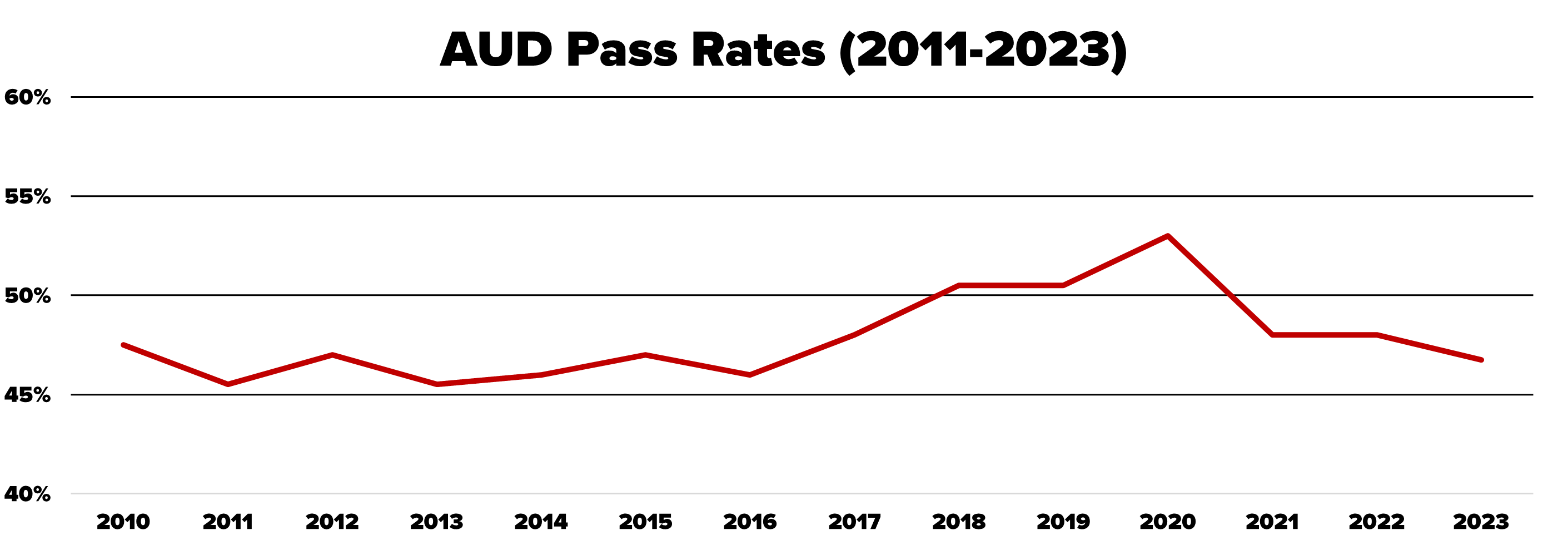

The AUD section tends to be on the upper end of the scale as far as CPA Exam difficulty is concerned, with pass rates hovering around 48%. FAR had the lowest average pass rate at almost 45%. While the REG section historically tended to hover around 50%, in 2021 it jumped to almost 60%, REG’s pass rate continues to rise. These percentages shift a bit from year to year, but the CPA Exam sections’ relative difficulties historically have followed this trend.

Take a more detailed look at CPA Exam pass rates, including seasonal trends.

Remember, statistics are useful, but they can’t tell you what your performance will be. You aren’t locked in at a 50% chance to pass! The more you apply yourself to your studies (and the more practice exams you take), the more your outlook improves.

For more information about how the CPA Exam has evolved over time and what’s new this year, visit our CPA Exam Changes page.

The AUD CPA Exam section consists of five testlets: two testlets of multiple-choice questions (MCQs) and three testlets of task-based simulations (TBSs). The MCQ portion of AUD accounts for 50% of your CPA Exam score, and the TBS portion accounts for the other 50%.

AUD Format Breakdown

Testlet 1 39 MCQs

Testlet 2 39 MCQs

Total MCQs: 78 | Scoring: 50%

Testlet 3 2 TBSs

Testlet 4 3 TBSs

Testlet 5 2 TBSs

Total TBSs: 7 | Scoring: 50%

Testing Time 4 hours + 15 min break

Most AUD testlets include operational and pre-test questions. Operational questions count toward your total exam score and pre-test questions do not. That said, the questions are indistinguishable from one another, so don’t waste any valuable testing time trying to decide whether you can afford to skip a question!

AUD Question Categories | ||

Question Type | Operational | Pre-test |

MCQs | 60 | 12 |

| TBSs | 7 | 1 |

The AICPA looks to continuously evolve and improve the CPA Exam. Pre-test questions are potential future exam questions the AICPA is trying out by inserting them among real exam questions on AUD and other CPA Exam sections. This lets it study how suitable the questions will be for future use.

The AICPA already knows what topics the operational questions test and how difficult they are, so it can analyze candidate performance on pretest questions with the operational questions serving as a sort of control. While no one likes to be a guinea pig for experiments—especially on an exam this difficult—keep in mind that your score on these questions will not count.

The pre-test questions that meet the AICPA’s standards are included as operational questions on later iterations of the exam. This pre-test period is also used to assign a difficulty level to questions for grading purposes, and questions continue to undergo statistical analysis based on the live exam.

THE GLEIM SOLUTION

Pre-test questions may be more difficult than operational questions, but because you can’t tell which is which, it’s best to answer all questions as best you can. If it helps, whenever you encounter a really difficult question and aren’t sure of your answer, just tell yourself it’s probably a pre-test question and keep moving!

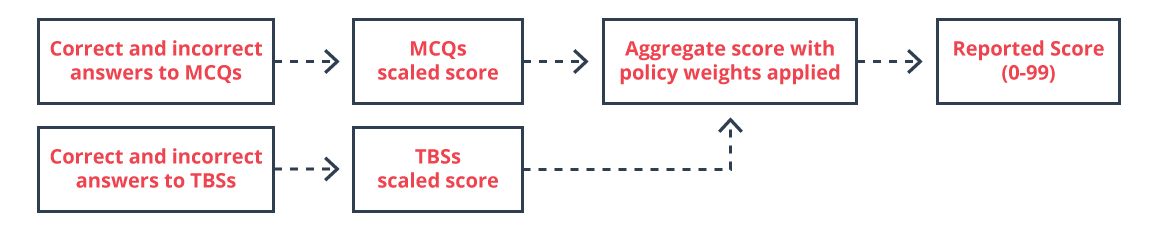

Computers grade all CPA MCQ and TBS testlets. Your score is scaled according to the difficulty of the MCQs you answered correctly and the credit you receive on the TBSs. (See more on how the CPA Exam is scored.)

The passing score for all CPA Exam sections is 75 points or higher.

This does not necessarily mean you need to answer 75% of questions correctly.

Difficult questions are worth more points, so a strong performance on the first MCQ testlet can give you an opportunity to earn even more points in the second MCQ testlet. Difficult questions are also more time-consuming, so you’ll need to practice a time-management strategy to optimize your score.

The CPA Exam is not curved in the same way as other exams you might have come across in your accounting studies. Instead of adjusting your score based on how your cohort does, the AICPA uses question weights. These weights are assigned based on how candidates fared with the questions on previous exams. So your score is impacted by the performance of past test takers, not current ones.

It’s worth repeating here that your score is not a percent. You don’t have to get 75% of the questions right—you just need a score of 75. If you think you’re borderline passing, you’re probably fine. A 65% may in fact be 75 points after it’s scaled.

Yes, you can receive partial credit on TBSs! Never leave any part of a question blank on AUD (or other sections for that matter), and always double-check to make sure you’ve answered all parts of a question. No two TBSs are the same. They can have wildly different formatting and require you to input your answer in different ways, so stay sharp.

For more information on how your AUD section will be scored, please check out our guide to CPA Exam scoring. You can also see the AICPA’s FAQs or contact one of our Personal Counselors. We’re always here to help!

AUD covers every part of the audit process. The AUD section will test engagements in accordance with professional standards and/or regulations by the:

Candidates are expected to demonstrate knowledge and skills related to:

The subject matter is divided into four major content areas.

| AUD CPA Exam Content For a breakdown on the exam contents, click the links below. |

|

|---|---|

| Content | Percentage |

|

Ethics, Professional Responsibilities and General Principles |

15-25% |

| 25-35% | |

| 10-20% | |

| 30-40% | |

The AICPA publishes CPA Exam Blueprints that specify exactly what a CPA needs to know, all the way down to specific tasks. It’s good to look over the higher-level concepts to get a broad idea of what you should be taking away from your studies, but the Blueprints aren’t really useful for candidates in making a study plan. The Blueprints are incredibly detailed (they break down even further than above), and if you were to go through them on your own, you’d likely spend just as much time figuring out what to study and how much time to devote to each topic as you would actually preparing for the exam.

Our recommendation is to let a CPA Exam review course provider do the bulk of the work for you. All major providers have teams of experts that dig into each Blueprint update, taking the guesswork out of studying. (Learn more about choosing the right review course for you.)

With the introduction of Continuous Testing, new accounting and auditing pronouncements may be tested the later of (1) the calendar quarter beginning after the pronouncement’s earliest mandatory effective date or (2) the first calendar quarter beginning six months after the pronouncement’s issuance date.

Changes in uniform acts are eligible to be tested in the calendar quarter beginning one year after their adoption by a simple majority of the jurisdictions.

For all other subjects covered by the CPA Exam, changes are eligible to be tested the later of (1) the first calendar quarter beginning after the earliest mandatory effective date or (2) six months after the issuance date.

Once a new pronouncement is testable, questions testing the old pronouncement will be removed.

Gleim CPA Review Courses are automatically updated to reflect the latest material that could appear on an exam.

The AUD section of the CPA Exam isn’t easy, and one factor contributing to CPA Exam difficulty is the fact that the exam assesses candidates at four different levels of skill. The pass rate for AUD hovers around 50%, so it’s important to make sure you have a firm grasp of the subject matter.

AUD is the only exam section to test at the Evaluation level of higher order skills, and much of it is testable at the Application and Analysis levels. It’s especially important before you sit for AUD to make sure that you fully understand the core concepts. On the Task-Based Simulations (TBSs), simply choosing the right answer is not sufficient. You must be able to explain and support why your answer is correct.

Most people do not consider AUD as hard as FAR, and the pass rates below support that general consensus. However, AUD can still be a challenging section—it may give you questions that require financial accounting knowledge, and without that knowledge, you may find it difficult to attest to whether a financial statement is presented fairly.

If you have recently studied auditing in college or been working as an auditor, you may be equipped to take AUD first.

If you are not in either of these situations, we recommend you schedule AUD after FAR.

The total testing time for AUD is four hours, which is the same as the other CPA Exam sections. Stick to a per-question time allotment according to the question type:

MCQs

1.25 minutes each

TBSs

18 minutes each

AUD Time Allocation by Testlet | |||

Teslet | Format | Question Count | Time (in minutes) |

1 | MCQ | 36 | 45 |

| 2 | MCQ | 36 | 45 |

| 3 | TBS | 2 | 36 |

| 15-minute break (does not count toward total exam time) | |||

| 4 | TBS | 3 | 54 |

| 5 | TBS | 3 | 54 |

| Extra Time | 6 | ||

| Total | 72 MCQs / 8 TBSs | 240 | |

It will take a lot of practice to be able to answer questions quickly, especially because most AUD questions are conceptual. But as you learn the material and complete more sample questions, you’ll build mastery of the topics and your speed will improve.

As you can see, this system allots six minutes to use at your discretion. You can spend it on your MCQ and TBS answers. Just remember, you can’t revisit any previously submitted testlets, so only use the banked time if you need it.

AUD is a difficult exam section, but it’s not impossible to pass.

The Gleim Premium CPA Review course can help you pass AUD on your first attempt. Our course covers the exam content better than any other and always contains the most up-to-date information. Our SmartAdaptTM technology constantly adjusts to help shore up any weak areas, which helps maximize your study time. It also features cumulative review questions to promote maximum retention of AUD topics—repetition over regular intervals is one of the study techniques proven to increase recall.

The AUD questions you’ll see in Gleim CPA Review are just as challenging and realistic as those on the actual exam, and by the time you complete our Final Review, you’ll be completely prepared and confident for exam day!

Want to see if you’re eligible to take the CPA Exam? Learn more about CPA Exam requirements today.

1. Use real-life experience to understand the audit process.

The core audit process is a significant part of the of AUD CPA Exam section, so you should understand it thoroughly. Even though the auditing process itself is pretty straightforward, having an accurate image in your mind of how auditors complete the audit process and the kinds of questions on their minds can greatly enhance your comprehension.

Spend a day in the life of an auditor. Ask an auditor to walk you through how they would go about completing a typical audit. Then, compare the scenarios in the exam questions to your knowledge of what auditors do in real life.

2. Get a firm grasp on the audit report.

The AUD section of the CPA Exam expects you to be thoroughly acquainted with the audit report, which includes several kinds of opinions that deviate in their content and layout. Familiarity with the audit report is essential because you could be asked to modify or replace part of an opinion in a document review simulation (DSR). Or, in a multiple-choice question, you may be asked to select which kind of opinion is expressed.

Because of how the exam tests the audit report, the most efficient way to study for AUD is to first memorize the main audit report, which is the unmodified opinion, and then learn differences between the other opinions and the distinct sections that need to be included for each.

Gleim CPA Review has an entire Study Unit dedicated to discussing the audit report and how it changes according to the type of opinion expressed. You can preview our audit report coverage by signing up for a free CPA demo.

3. Shore up your knowledge of internal control.

The principles of internal control will remain relevant to your accounting career long after you pass the CPA Exam, so you can’t really over-prepare for this topic. If you aren’t sure what to spend time reviewing, you could always run through internal control once more.

If you use a Gleim Review System, our SmartAdapt™ technology will help you figure out what to study to maximize retention and strengthen any weak areas.

4. Memorize, but in the context of the big picture.

The areas of accounting AUD involve a variety of steps, standards, and procedures, and memorizing this information can be helpful.

But rote memorization alone won’t earn you a passing score. Instead, you should memorize steps within the context of the big picture: what is the purpose of an audit, and what issues are specific audit steps meant to address? AUD tests at the Analysis and Evaluation levels of knowledge, so you have to master the topics comfortably in order to pass this CPA Exam section.

5. Work on techniques for coming up with the right answer.

In order to thoroughly challenge you, the CPA Exam offers more than one answer choice that may seem correct. You must carefully scrutinize the choices in order to determine the best possible answer. To find the best possible answer, try to quickly rule out answers containing absolutes. The words “all,” “never,” “always,” and “none” can indicate an incorrect answer choice because such extreme consistency is usually not realistic in the context of an audit report.

There is more you can do. We’ve got an entire section dedicated to increasing your odds of selecting the right answer.

If you’re looking for a start-to-finish CPA Exam walk-through, check out our free CPA Exam Guide for more information! This free PDF contains our top tips for scheduling, studying, and sitting for the CPA Exam.

Visit our CPA Exam Resource Center to view our latest CPA Salary Report, confirm that you meet CPA Exam requirements, and more.

15-25% Ethics, Professional Responsibilities and General Principles

25-35% Assessing Risk and Developing a Planned Response

10-20% Forming Conclusions and Reporting

30-40% Performing Further Procedures and Obtaining Evidence